EUR/USD

The EUR/USD pair initially tried to rally this past week, but as you can see fell backwards almost right away. With this, it appears that the pair will continue to struggle for the time being, and I believe that the market is now heading to the 1.35 handle, where it will find massive amounts of support in my opinion. The breaking below of that area would be very significant, and with summer coming, I think we will hold down there. I expect a summer range between 1.35 and 1.40 this year.

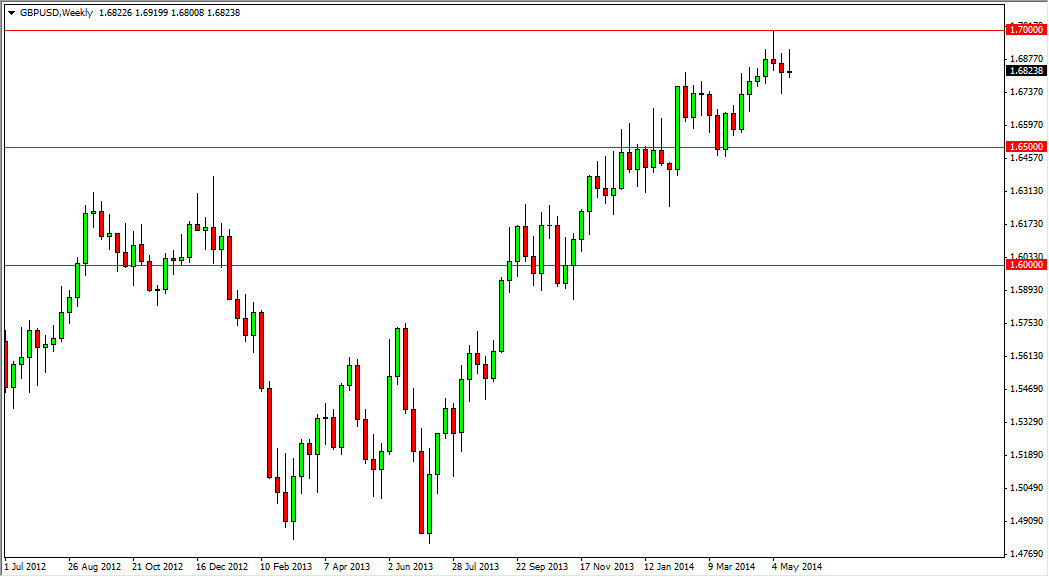

GBP/USD

The GBP/USD pair struggled the second half of the week, and therefore formed a shooting star. This candle suggests to me that we are going to continue to meander around this area, but ultimately I think this pair will break above the 1.70 handle – which allows the Pound to go to the 1.75 handle over time. Pullbacks offer buying opportunities, and I also think that this area is simply acting as a momentum building stage.

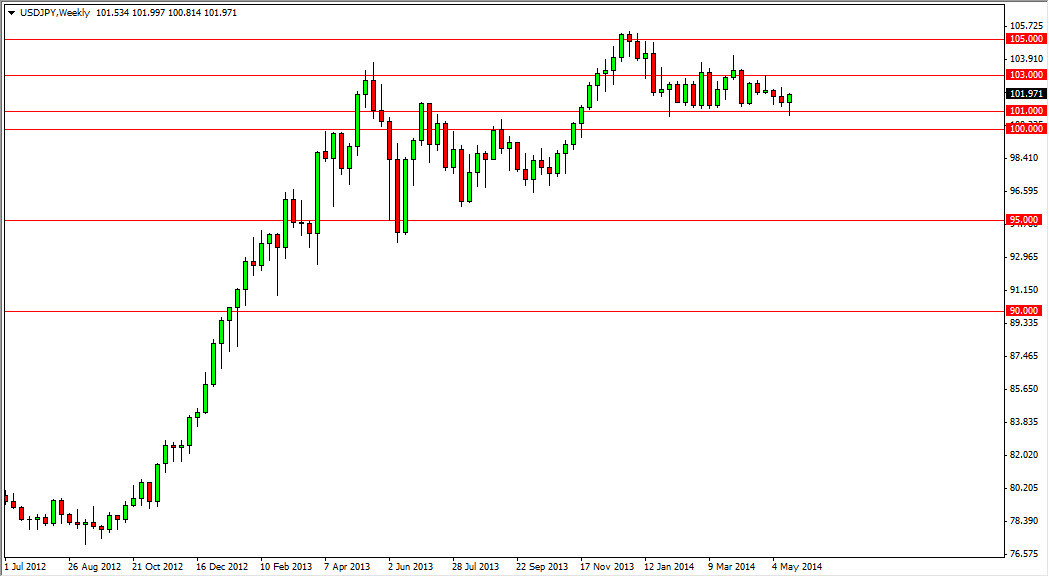

USD/JPY

If there was ever a poster child for “dead money”, it would be this market. The pair simply seems “stuck” between the 101 and 103 levels, but I still believe we will eventually go higher. I think that the hammer from this past week should be a bullish sign though, and although we are range bound, I am only taking longs at this point as I think the uptrend will continue – eventually. This market should start to follow interest rate differentials, and this means that the pair should eventually rise. I think by the end of the year, 110 is still possible.

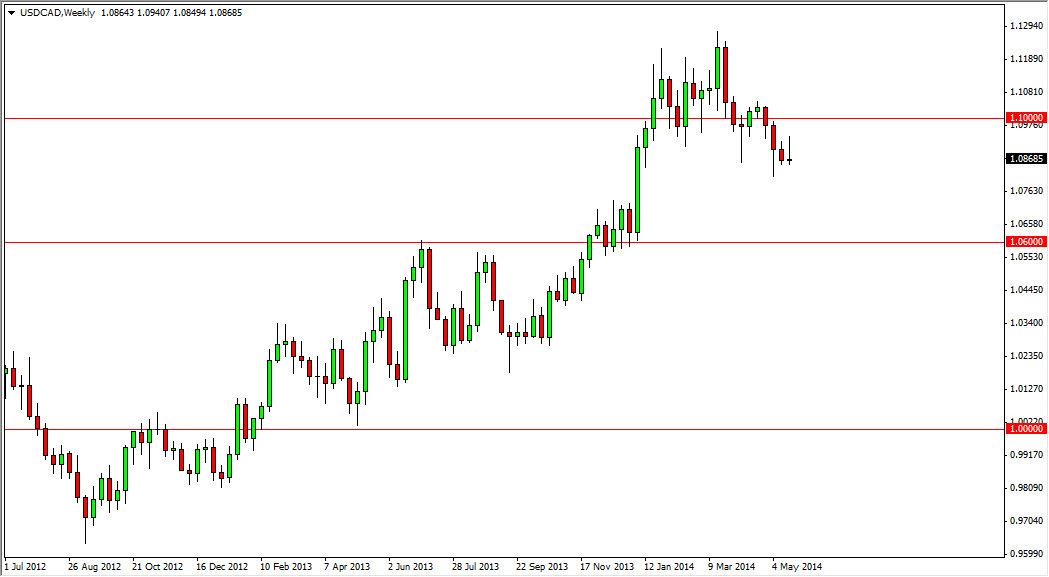

USD/CAD

The USD/CAD pair tried to rally during the week, but has found the 1.09 level to be too rich at this point. The pair of course is influenced by oil markets – which are breaking out to the upside at the moment. The pair looks set to grind its way down to the 1.06 level in the meantime, and with that I am more than willing to start selling to aim for that level on a break of the lows. However, I am fully aware that the 1.06 level starts a new and massive support zone. I would be prepared to switch my position in that area on a supportive candle.