AUD/USD

The AUD/USD pair ended up forming a very neutral candle as we finished the week unchanged, sitting just above the 0.9250 level. That area should be support, based upon the fact that it was so resistive in the past. With that, if we can break the top of the candle, I feel that the market heads to the 0.95 handle. As a side note, the gold market formed a hammer for the second week in a row, which of course is very bullish. This bullishness could be reason enough for the Australian dollar to continue going higher.

EUR/USD

The EUR/USD pair initially fell during the week, but as you can see found enough support below to turn things back around and form a hammer. This hammer of course is a positive sign, but I feel that the market will struggle to get above the 1.40 level as the ECB has essentially made it the “line in the sand.” Because of this, I find it difficult to buy this market until we get above that level on at least a daily close. As far as selling is concerned, there is quite a bit of support below, so I have no interest in doing that.

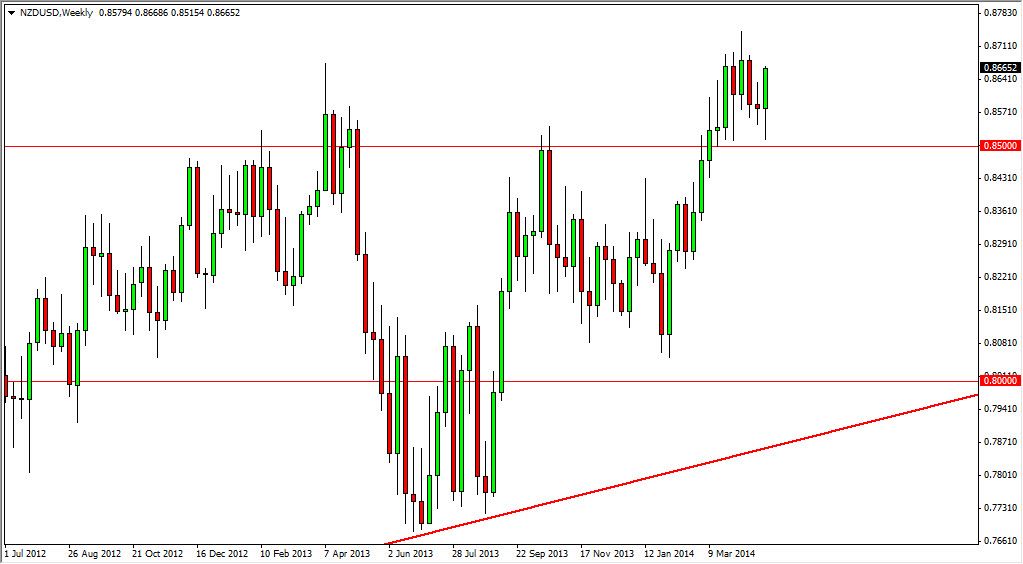

NZD/USD

The NZD/USD pair initially fell during the week, but found the 0.85 level to be supportive enough to turn things back around and form a positive candle. This candle has the shape of a hammer, although it is and quite the same thing. It does appear though that the market wants to breakout to the upside, so if we can get above the recent high from 3 or 4 weeks ago, we would be buyers. Pullbacks on short-term charts should continue to be buying opportunities as well, and of course you will have to watch the commodity markets as the New Zealand dollar is heavily influenced by them

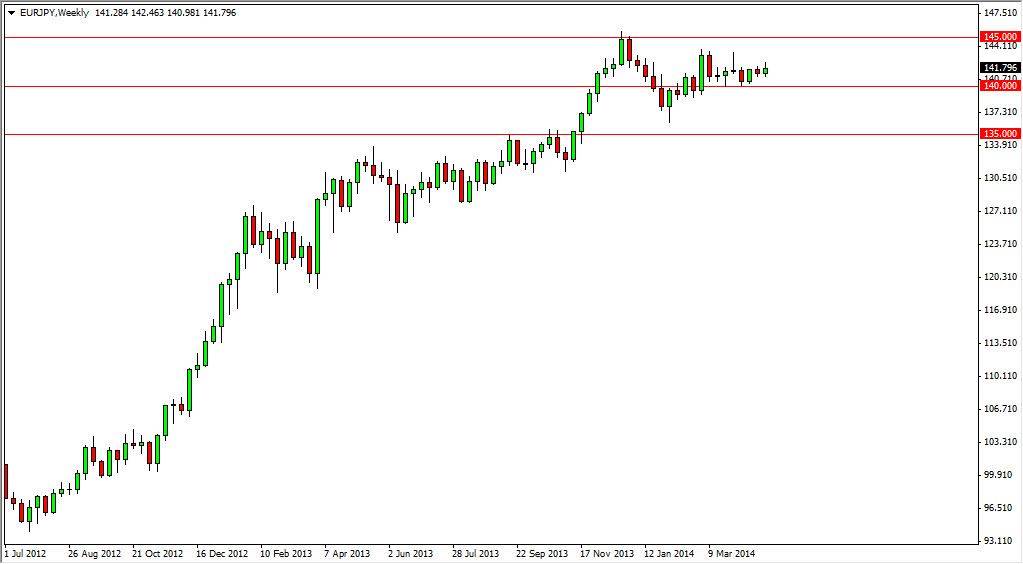

EUR/JPY

The EUR/JPY pair rallied during the week, but gave back about half of the gains in order to form something along the lines of a shooting star. However, there is plenty of support just below, so I am not interested in selling this market. I recognize that the 140 level should continue to be supportive, so a type of supportive candle in that general vicinity has me buying. I believe that the market will eventually break above the 143 level, and aim for the 145 handle.