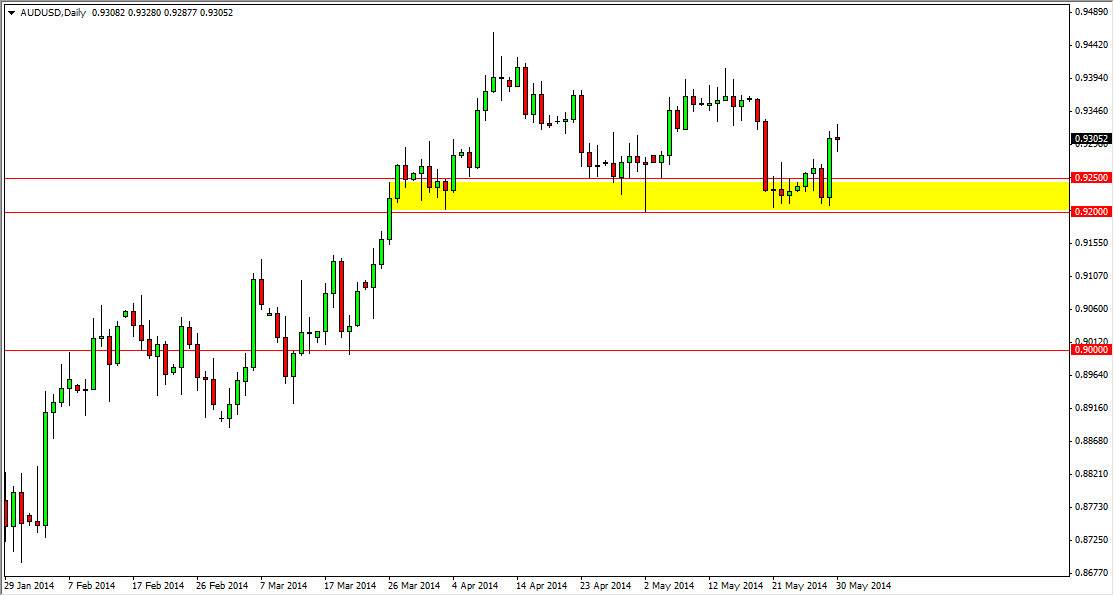

The AUD/USD pair went back and forth on Friday, testing the 0.93 level for both support and resistance at the same time. The resulting candle of course is a neutral candle, which suggests to me that this market ran out of steam during the session. That’s not a big surprise though, as the massive move higher on Thursday probably caught a lot of traders off guard. However, that’s not a big surprise to me simply because the 0.9200 level shows such a massive amount of support over the course of the last couple of months.

At the top of the recent consolidation area, the 0.94 level has offered of resistance. With that, there’s a 200 PIP range that we are trading in, which is plenty for the shorter-term charts. Because of this, I feel that buying a short-term pullback is probably the route to go as we have certainly seen an impulsive move higher, which of course leads me to believe that we could possibly breakout to the upside of the consolidation area eventually in order to continue the move higher from the absolute lows.

Gold markets and the risk appetite of traders.

I believe that this market will eventually follow whatever gold does, as it typically will do over the longer term. That being the case, watch both markets as one could lead the other as it is relatively common. The same thing can be said for general risk attitude of the markets, as although there is no real direct correlation between a specific stock index and the Australian dollar, it’s more like the general “feel” of the markets on the whole.

On the other day, if we do break down below the 0.92 level, I think that the market will try to find its way down to the 0.90 level, as it is significant support. However, I think that there could be a pop along the way down at the 0.91 handle, but it is the beginning of support, not the actual support itself. With that being said, we have a nice range from which to play this market, and I suggest looking at short-term charts for entries although at the moment I have to have an upward bias.