By: Ben Myers

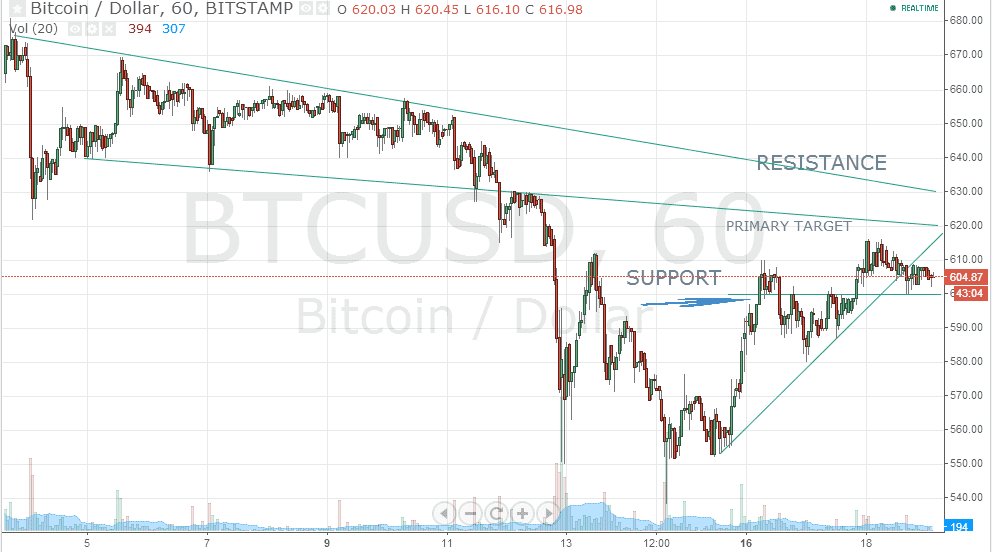

The price of BTC/USD, after having taken out the previous top of 605, failed to maintain its upward momentum and has retraced more than 1% from the high of 615 and has even retested the near-term support of 600. The pair is facing bouts of profit-booking at higher levels and is currently consolidating after breaking down from the upward sloping trend line (marked in the hourly chart).

Traders can look forward to building long position now and on successive declines up to 600 for a primary target of 620 and a final target of 630, maintaining a stop-loss around 595. Aggressive traders may hold their positions till 630 is achieved while traders with a low-risk appetite can book partial profits (60%) near the primary target of 620 and the remaining near the strong resistance zone of 630.

Short positions should be considered only after either the price has broken below 595 or if the pair is near 630. A close below 595 could puncture all positive momentum and only short positions should be considered keeping a stop-loss of 600 for an initial target of 580 and a final target of 560. Similarly, the levels of 625-630 can act as strong resistance for BTC/USD and should be used to sell for targets of 600-610.

Traders and investors must note that there are important events lined up next week such as the second meeting of the Italian Parliament on 26th June 2014 and the auction of the 30,000 Bitcoins by the US Marshals Service (USMS) on 27th June. Positions must be built and stop-losses must be strictly followed keeping in mind that each can trigger a spike in the value of the digital currency.

British grooming brand King of Shaves has announced that it will accept Bitcoin payments through BitPay, joining the likes of world renowned companies such as Dish Network, EBay and Expedia adding further credibility and long term sustenance to the digital currency.