By: Ben Myers

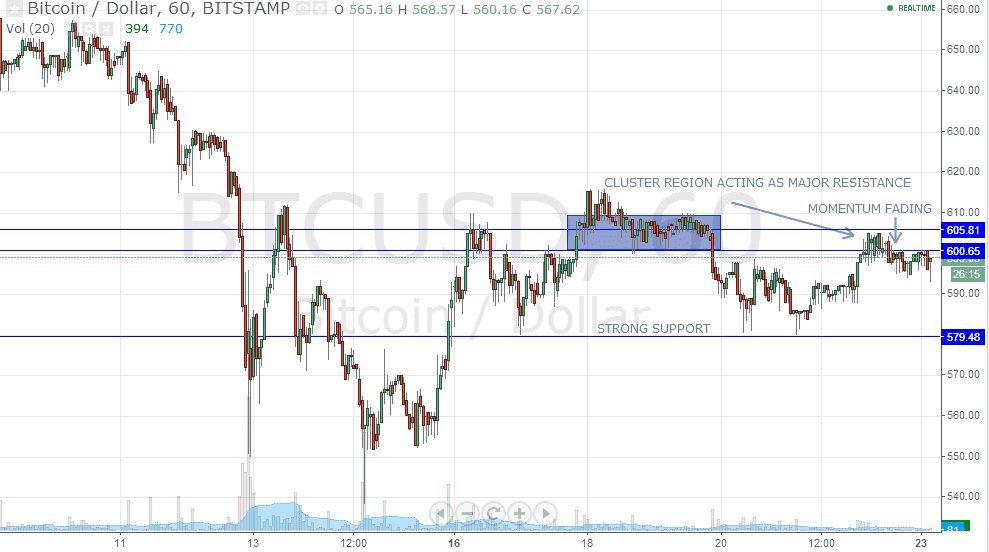

The price of Bitcoin is trading near the important level of 600. The significance of this level can easily be gauged from the hourly chart above, which easily shows the level being tested numerous times and hints that a big move may be on the horizon. After forming a cluster zone (marked as the rectangular box in the figure) between 18th June and 20th June, the bulls have been continuously trying to get past that level but have failed to do so. The price after having established a support at around 580 managed to push up and take out 600 on the upside, but since then, the momentum has been fading and the pair has slipped below 600 again.

Traders may adopt a “sell on rise” strategy for targets of 590-580 near 605-610 with strict stop-loss placed at around 610-615. A close beyond 620 could accelerate the upward momentum and all short positions must be cut then. Also, buying can be initiated around 585-590 for targets of 605-610 with a stop loss placed around 580. It should be noted that a breach below the support level of 580 could trigger a fall towards its previous lows of 550.

Also, in a major development Bitcoin has managed to garner a vote of confidence from the US congressman Jared Polis, who said that he would be “happy to rally support in the Congress to restrict the funding of any agency which will react in an irrational negative way towards digital currencies.” This statement comes at a time when the auction of approximately 30,000 Bitcoins valued at over $17 million by the US Marshals Service is to take place on 27th June 2014.

Bitcoin has traditionally been very news-driven and such news and development could surely affect the price significantly and hence, all trading positions should be made keeping abreast with the latest developments on all fronts related to Bitcoin. Investors may wait out the auction to get clarity on the price front.