By: Ben Myers

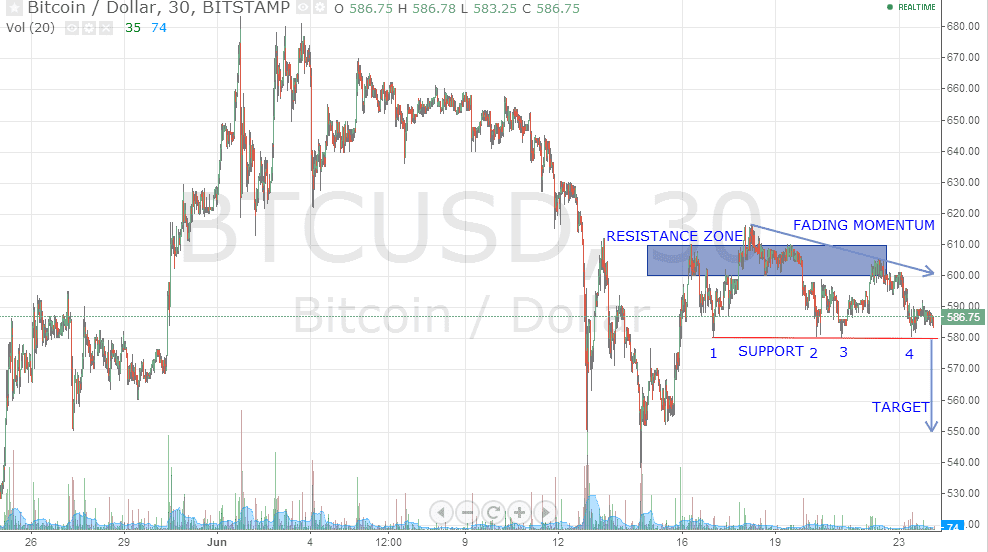

The price of Bitcoin against dollar has again slipped below 600 to the support level of 580 which clearly signifies the lack of strength in bullish momentum. After sustaining above 600, the digital currency turned on its head and dived to 580, which has now been tested numerous times (marked in the figure above) but has managed to sustain above it. A breach below the important support level of 580 opens the downside for a target of 550. The price band of 600-610 (shown as the rectangular box above) continues to resist any buying momentum and successfully manages to push the price lower.

Since the price at higher levels is marked by consolidation/distribution, it gives the bears a lucrative opportunity to build short positions. This “sell on rise” strategy can be adopted around 590-595 for an initial target of 580 and a final target of 550 placing a strict stop-loss at around 600.

Risky traders can also look forward to buying the pair around 580 and selling it at a profit around 590. The “buying on dips” strategy must be followed with a strict stop-loss set at 579.

After US congressman Jared Polis, who has resolved to protect Bitcoin and act against any agency who irrationally threatens the growth of the digital currency, it has now got the backing of a Minnesota senator, Branden Peterson, as well, who is the executive director and board chairman of Yesbitcoin. Yesbitcoin is a Bitcoin-focused, non-profit which aims to promote the digital currency and its benefits to the general public.

The Parliament of Canada has passed a bill that amends the country’s national law, Proceeds of Crime and Terrorist Financing Act 2000, to regulate the domestic and foreign businesses dealing in Bitcoin.

XPRIZE founder and Chairman, Peter H Diamandis, has emerged as another staunch supporter of Bitcoin, whose confidence in the virtual currency has grown to such an extent that he is trading a portion of his gold holdings for Bitcoin.