By: Ben Myers

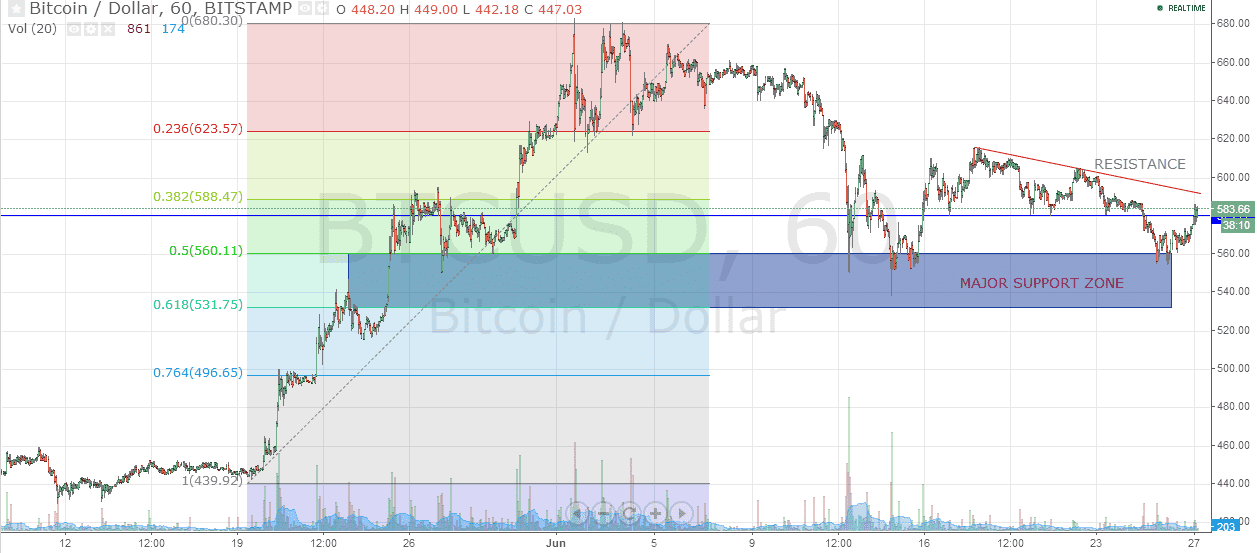

Bitcoin is currently trading near its previous support level of 580 which is just at around 2-3% below the resistance level of 595. The price action of Bitcoin suggests that a big move is around, and that the Bitcoin auction to be held today can play a direction-defining role. While the Fibonacci retracements levels of 61.8% and 50% have acted as a major support in the past (marked above), the levels of 600-610 have acted as a major hindrance to the upward momentum. A close beyond either of the levels would accurately define the direction and fresh positions should be made accordingly.

Aggressive traders may short the pair around 595 placing a strict stop-loss around 600 for a target of 560. Similarly, traders with a contrarian view can look to build long positions around 550-560 for a target of 590 with stop-loss fixed at 540. This range trading should be followed with strict stop-losses as the instrument is known to swing wildly.

In case the range is taken out after the auction, short positions should be made only below 540 for a target of 500 with stop-losses set at 550. Fresh long positions should be made only above 615 for a price of 640-660 with a stop-loss set around 600.

Traders and investors must also keep up with news coming out of various sources as Bitcoin is known to be highly news-driven. The Organization for Economic Cooperation and Development (OECD) has shared a positive outlook on the digital currency in its recent paper and vouched that the Bitcoin protocol could have a significant role to play in the financial system. The US Consumer Financial Protection Bureau (CFPB) has been asked by the Government Accountability Office (GAO) to boost its oversight of Bitcoin to keep it under tight regulation.