By: Ben Myers

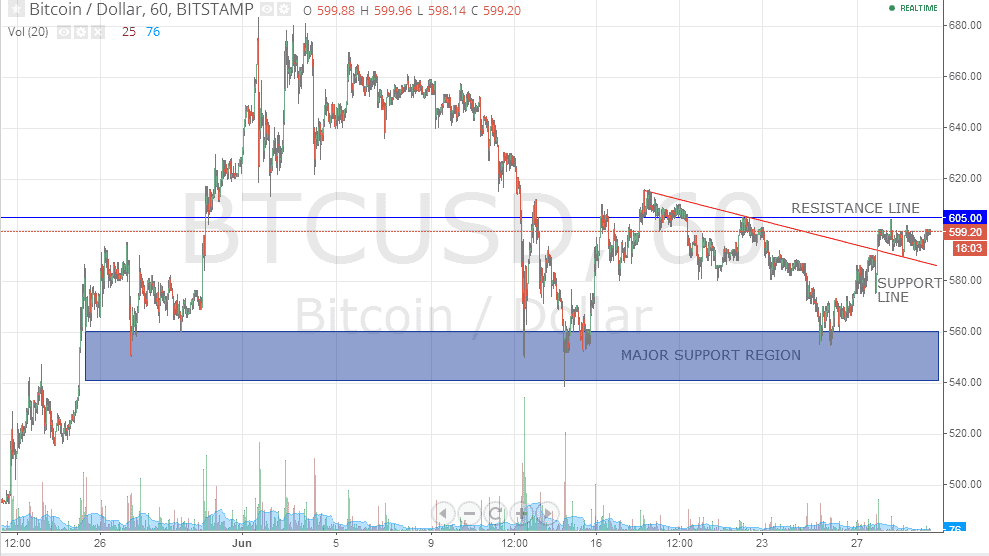

After a short-lived rally, Bitcoin has again slipped into consolidation mode. BTC/USD, which managed to break out from its lower-top lower-bottom price structure owing to the auction held by the US Marshals Service on the 27th June has once again formed a narrow range near 600. The auction failed as a major trigger and wasn’t able to provide a significant breakout. The upward momentum is waning and the pair awaits an even bigger trigger to free it from this range. BTC is currently trading near 600 and looks like facing resistance in the range of 605-610.

Technically, Bitcoin, which was earlier in a lower-top lower-bottom structure, has breached the downward sloping resistance line (marked as a red line in the image) on the upside and has retested it to confirm it as a near term support. The level of 600 continues to be a strong resistance zone and may be used to short the pair for a target of 580 while placing the stop-loss near 605. Bullish positions must be created only after a correction as there are no signs of a strong upward momentum as yet and buying at lower levels would provide much better trading opportunities. Hence, long positions can be made in case the pair corrects to 580-585 for a target of 600 keeping a stop-loss just below 580.

In a landmark move, the Governor of California, Jerry Brown has officially signed the Assembly Bill 129 to grant “legal money” status to Bitcoin and other digital currencies, into a law. The move is aimed at encouraging the use of alternative currencies in a legal way and adds support to the current bitcoin price,

The price action in recent trading sessions has reaffirmed the region of 540-550 as a major support zone and medium to long-term investors may initiate buying at current levels and on declines until the support is held.