By: Ben Myers

The price of BTC/USD in the past week, has witnessed considerable action in the hourly charts, which consisted of a failed upside momentum, a breakdown from an important support level and the resistance being challenged continuously. Some key developments also took place which have kept the price in a tight range and have not let it deviate beyond 4% on either side.

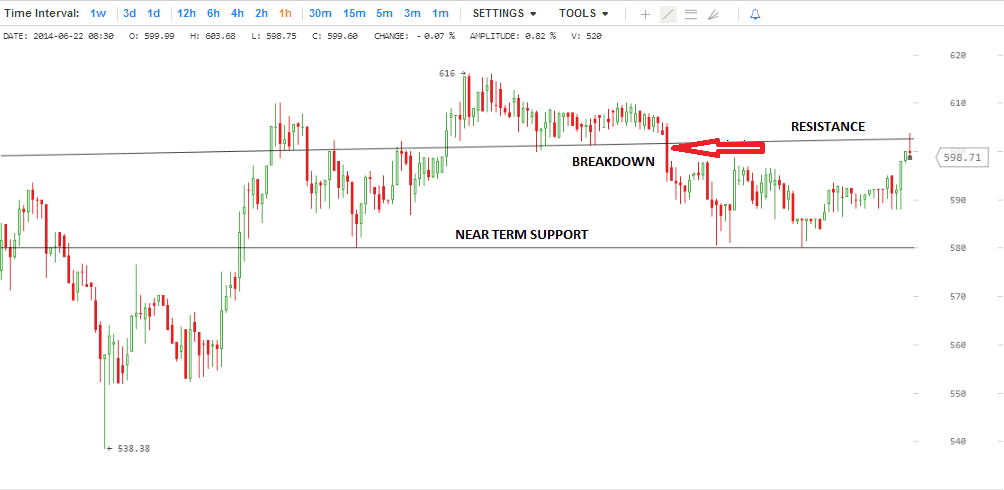

The price of Bitcoin after having given a breakout at above the 600-level earlier in the week, reached a high of near 615 but it failed to sustain at higher levels. While sustaining above 600-levels for an ample period of time, the pair showed no strong reversal patterns and subsequently gave ground and broke down below its important support level of 600 to reach 580. The pair has touched 580 twice recently (marked in the chart) and has formed a near-term support around that level and tried taking out 600 but failed.

Several major developments that have taken place include the ban by the Bolivian Central Bank. El Banco Central de Bolivia. The central bank has banned any currency or coins not issued or regulated by the government including Bitcoin. In the meantime, Russia has decided to disclose its stance on the use of the digital currency in its upcoming report to be published by the Financial Action Task Force (FATF), which is an inter-governmental body aimed at curbing money laundering and terrorist financing. Also, reports have surfaced of China’s Bitcoin exchanges looking for foreign investors and buyers since the Chinese central bank, the People’s Bank of China, has not eased its Bitcoin-averse policies. Earlier this week, Coinbase endorsed an unofficial Bitcoin wallet available on the Apple App Store for its users.

In the week ahead Investors and traders are eagerly looking forward to the Bitcoin on the 27th by the US Marshals Service which will provide strong movement in BTC/USD, most likely upwards, and we could see previous resistance levels broken and the price comfortably reach $650.