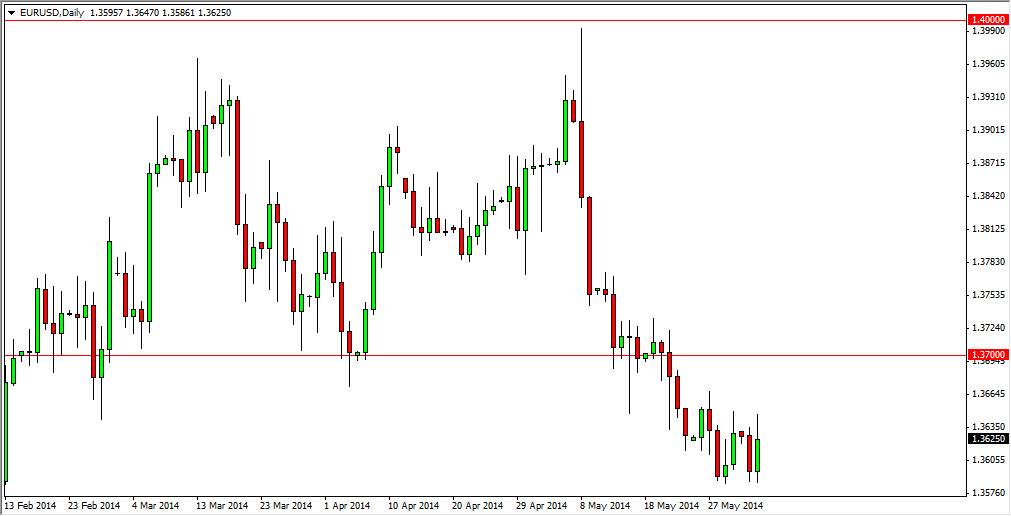

The EUR/USD pair rose during the course of the session on Tuesday, bouncing off of the 1.36 region, as that area continues offer support. Right now, the market looks a little bit stagnant and it makes complete sense we consider all of the things coming up this week. The two most important events of the week for the Forex markets will be the European Central Bank meeting on Thursday, and of course the nonfarm payroll numbers on Friday. That being the case, it doesn’t surprise me at all that this market would continue to go sideways, and as a result I think that is going to be difficult to trade this market between now and the end of the week.

I personally don’t think that the EUR/USD pair will be the place to be this week, but ultimately we should continue to find this a difficult and choppy market. However, by the time we get the announcements at the end of the week, I think that we could at that point in time have made a decision.

Ultimately, I think that this market will be disappointed by the ECB.

I believe that the European Central Bank will disappoint given a long history of doing so. The markets are expecting some type of massive quantitative easing when it comes to the Euro Central Bank, and as a result the Euro has been sold off rather drastically. However, at the end of the day I think that the market should continue to be disappointed by the ECB, and it’s possible that the “smart money” is going to go into the Euro ahead of time giving in a little bit of support, but I think once the market gets the disappointing news out of Brussels, this market should in fact bounce drastically as the Euro has almost undoubtedly been oversold in general. Ultimately, I think we are going to try and form some type of summer range, and that could be determined by the moves that we get at the end of this week. I also think that the 1.35 level below will be massively supportive.