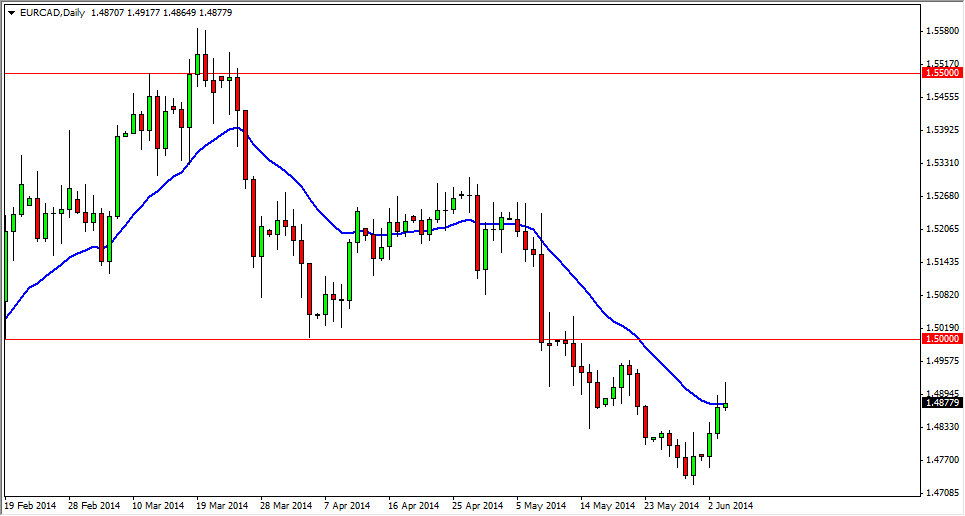

The EUR/CAD pair has bounced over the last couple of days rather significantly, but at the end of the day on Wednesday, we ended up running a nice-looking shooting star. This shooting stars about as perfect as they can get, based upon the shape alone and the fact that we are bringing up against the 1.49 area, in area that had a nice cluster recently. On top of that, it is with the overall trend, which of course always helps. Adding to the berries pressure is the fact that the often followed 20 day exponential moving average is slicing right through this candle as well.

The Canadian dollar obviously is greatly influenced by the oil markets, at least most of the time. Typically, the pair will fall as oil markets go higher. However, recently we have seen more of a general selloff in the Euro anyways, so you can also think of this market as representative of “Europe versus North America.” In other words, it should move roughly similar to the EUR/USD pair.

European Central Bank meeting today.

Pay attention to the European Central Bank statement later today, as it will let us know what the ECB is thinking. They tend to disappoint in my opinion when the market wants to see ultra-easy positioning, so I’m not surprised at all if the Euro gets whacked later today. After all, on one hand you could say that the Euro should strengthen because of the lack of monetary policy and listening, but on the other hand traders may look at that as an invitation to recession, which of course is not going to be good for the Euro anyway.

On top of that, Friday has the nonfarm payroll numbers coming out of the United States, and oil markets are often influenced by that number as well. This obviously could affect the Canadian dollar, and with that a bit of a run towards North America, meaning that both the Loonie and the Greenback could be winners at the expense of the Euro later on today. If nothing else, the chart simply loves like the market is ready to continue falling.