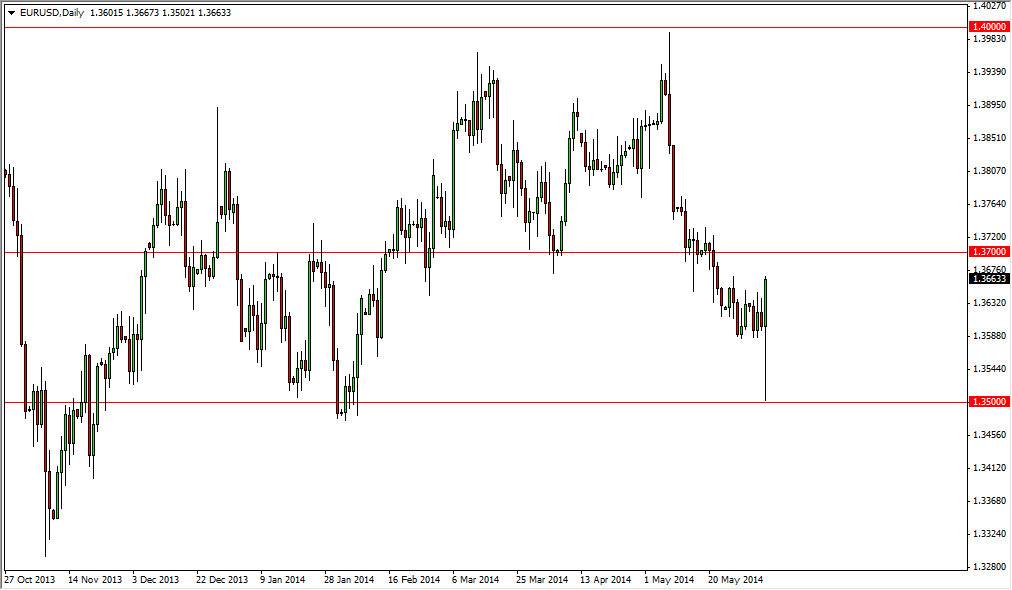

The EUR/USD pair initially plummeted during the session on Thursday, slamming into the 1.35 level. This was based mainly upon the idea of the European Central Bank cutting real interest rates to negative levels. However, the 1.35 level did in fact cause a massive rounds and formed a nasty looking hammer. Unfortunately, the 1.37 level above is resistive, and as a result it’s a bit late to get involved in this market from the upside. Adding to that pressure is the fact that today is nonfarm payroll Friday, and that naturally will cause a lot of volatility in this market.

All things being equal though, I think there is the potential for a nice set up during the day you are patient enough. After all, nonfarm payroll Friday tends to move the market around sideways and back and forth, so I am confident that if I am patient enough, I may get the opportunity for the trade that I’m looking for.

2 options, both of them involve me buying this pair.

I believe that there are 2 essential plays in this market right now. One would be lying on a dip, which is very likely during the nonfarm payroll announcement. The closer we get to the 1.35 level and a supportive candle on the short-term charts would be better for me, and quite frankly I think the smart move. However, I recognize that we may not get that pullback, and if we don’t then a daily close above the 1.37 level might be needed in order to start buying. I don’t really have a scenario in which I want to sell the Euro against the Dollar right now, mainly because it is so oversold to begin with.

However, I have to keep my eyes open and my options open as well. This market could be a sell if we get a resistive candle at the 1.37 level, but I need to see a daily close like that. A daily close above that level as mentioned above is a buying opportunity as well, but I am still hoping to get that short-term pullback after the announcement in order to start buying. If somehow we close below the 1.35 level, all bets are off in this pair falls apart.