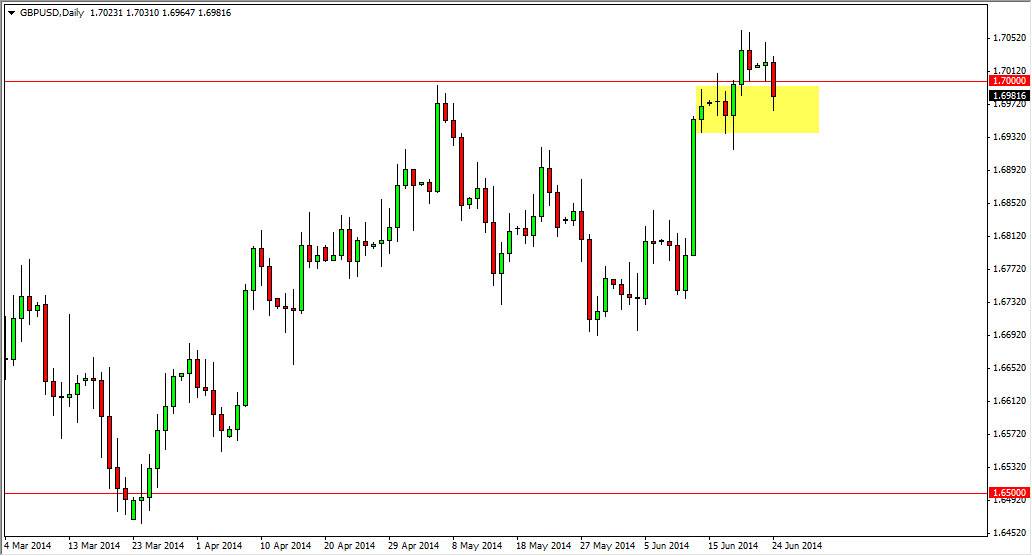

The GBP/USD pair fell hard during the session on Tuesday, slicing through the 1.70 handle. This is an area that I have been telling as significant support, and I still believe it to be. The reason being of course is the fact that the support runs all the way down to the 1.69 handle via the couple of hammers that formed two weeks ago. That being the case, I don’t see any reason to think that we should start selling anytime soon, and that support should come back into the marketplace.

Buyers stepped in towards the end of the day, and the sellers gave back some of their gains. That being the case, I think that the first supportive candle that you see is probably going to be a nice buying opportunity, as the market may simply have to grind sideways for a while to build up the confidence to continue the uptrend towards the 1.75 handle, which is my longer term target.

British pound strength everywhere.

I have seen British pound strength against many other currencies as well, and I don’t think that’s going to change anytime soon. Granted, the US dollar is on the other side of this argument, and that of course will be more difficult to gain against for the British pound as opposed to other currencies such as the Japanese yen which has a home central bank that wants the value of its own currency to drop. With that, I believe that this is a nice barometer for the value of the British pound overall, and the fact that we could fall down to drastically tells me that there are a lot of people out there still interested in owning it.

Ultimately, I believe that by the end of the summer we will see the 1.75 handle touched, but it could be a fairly choppy affair all the way up there. Short-term traders will continue to buy on the dips, and as a result I am long of this market, and will continue to be so until we break down below the 1.69 handle on a daily close.