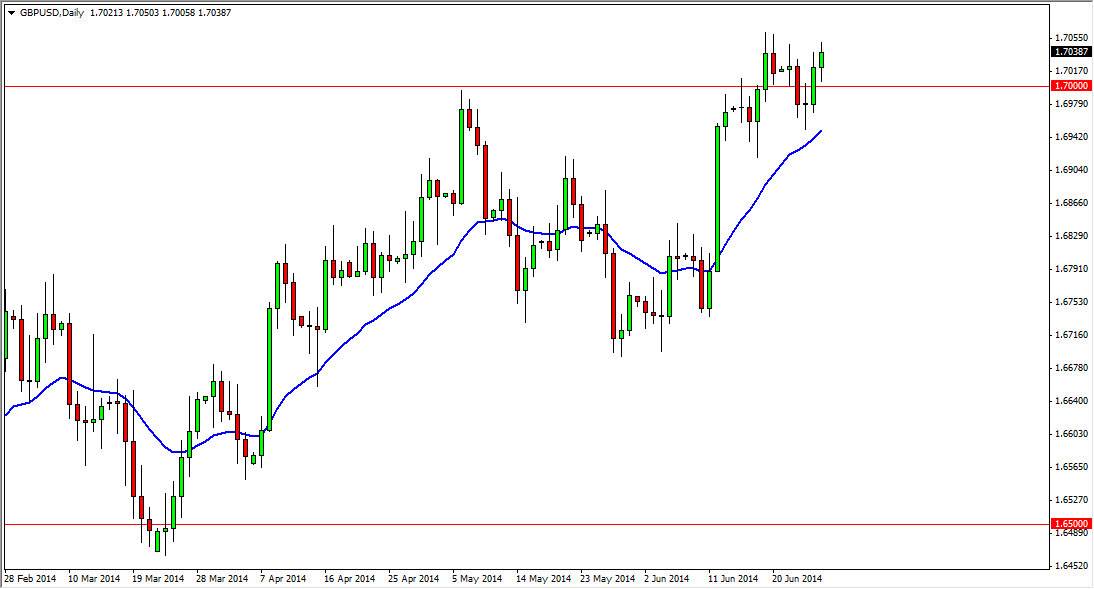

The GBP/USD pair initially fell during the session on Friday, but as you can see the 1.70 level has offered a bit of support. This area was one significant resistance, and the fact that we are starting to find buyers in this area is a very good sign. In fact, I believe that this market is ready to make a significant move higher, and that is only the beginning as far as this pair is concerned. I have high hopes for the uptrend, and as you can see the hammer that form for the Friday session is a good sign as well.

If we can break above the 1.7060 handle, I think we’ll have cleared the resistance, and the market should continue to go towards the 1.75 level but there should be a significant amount of choppiness along the way. We could see multiple dips going forward, and the market should offer plenty of short-term opportunities as well. It really comes down to what your time horizon is, but ultimately I think that the both short and long-term traders should find this to be a very profitable market this summer.

Never fight the trend.

You should never fight the trend, and the trend is most certainly up in this market. I really like the British pound, as the United Kingdom leaves recession, something that seems to be a bit of an anomaly these days. After all, even the countries that are not in recession are growing slowly at best. Now that the United Kingdom’s economy is getting better, the British pound is most certainly undervalued at this point in time.

Any pullback at this point in time should find plenty of support, and you can see that the 20 day exponential moving average is below as well, one that’s well followed by traders around the world. I think that the “floor” in this market is down at the 1.69 level, which of course is an area that has shown significant support and interest in buying the bullish alike. Ultimately, I expect this market the hit the 1.75 handle some time during the end of the summer.