GBP/USD Signal Update

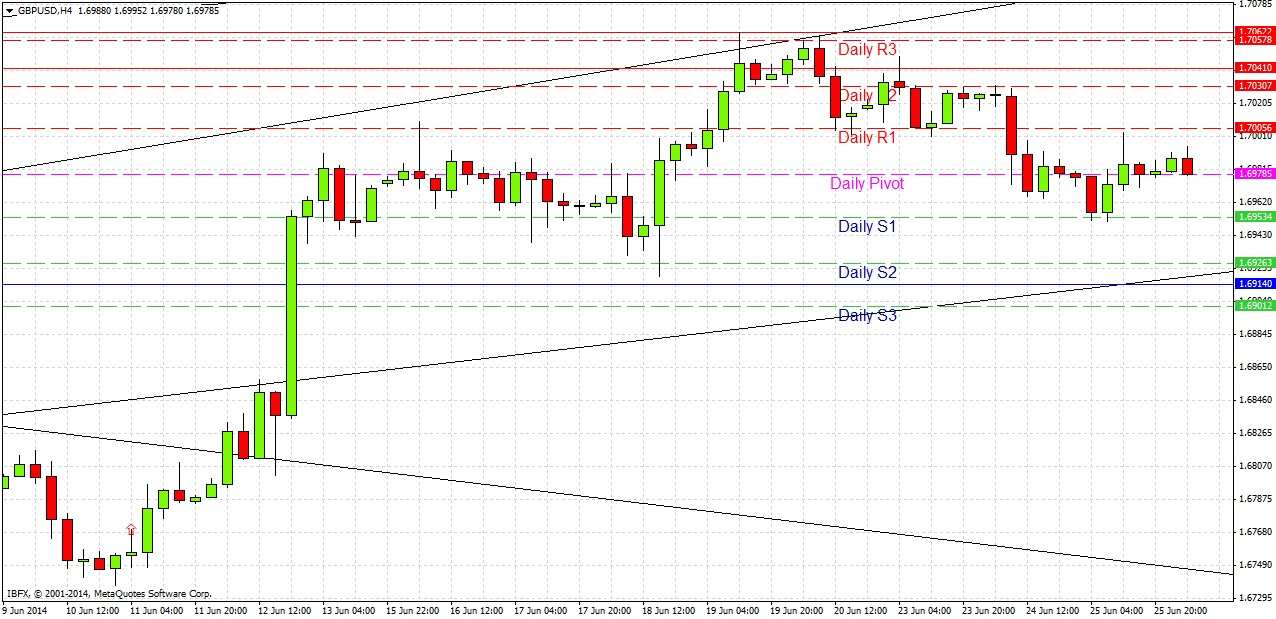

Yesterday’s signal expired without being triggered as the price never hit 1.6914.

Today’s GBP/USD Signal

Risk 0.75%.

Entry must be made before 5pm London time today.

Long Trade 1

Go long following bullish price action on the H1 time frame after the first touch of 1.6914.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6990.

Remove 75% of the position as profit at 1.6990 and leave the remainder of the position to ride.

GBP/USD Analysis

Yesterday was a quiet and insignificant day, we printed a doji on the GMT daily chart that opened and closed exactly in its middle, and we did not hit any key support or resistance levels. Yesterday does not really add anything new to the story.

We did spike up following the poor USD news to reach the 1.7000 level which seems to have flipped from support to resistance. If we had no news due today this might have been a good level at which to look for short scalps if you like to scalp, but we have key events due today that should make the pair more volatile than it was yesterday. As the 1.7000 level has been touched a lot during the past week or so, and as the resistance above that is somewhat unclear, I am not looking for any short trades right now.

There is still a key flipped support level below us at 1.6914. It is also quite confluent today with the very old, long-term bullish trend line. We are some way away from there but it might stop a sudden spike down. In spite of that, it will probably be best traded if confirmed by a bullish price action reversal.

The Governor of the Bank of England will be speaking at 10:30am London time, which is likely to affect the GBP. Later at 1:30pm there will be a release of US Unemployment Claims data, which may affect the USD.