GBP/USD Signal Update

Last Tuesday’s signals expired without being triggered as the price never hit either 1.3555 or 1.3688.

Today’s GBP/USD Signals

Risk 0.75%.

Entries must be made before 5pm London time today.

Long Trade 1

Go long following bullish price action on the H1 chart upon the first touch of 1.6684.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.6730.

Remove 75% of the position as profit at 1.6730 and leave the remainder of the position to ride.

Short Trade 1

Go short following bearish price action on the H1 chart upon the first touch of 1.6812.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6760.

Remove 25% of the position as profit at 1.6760 and leave the remainder of the position to ride.

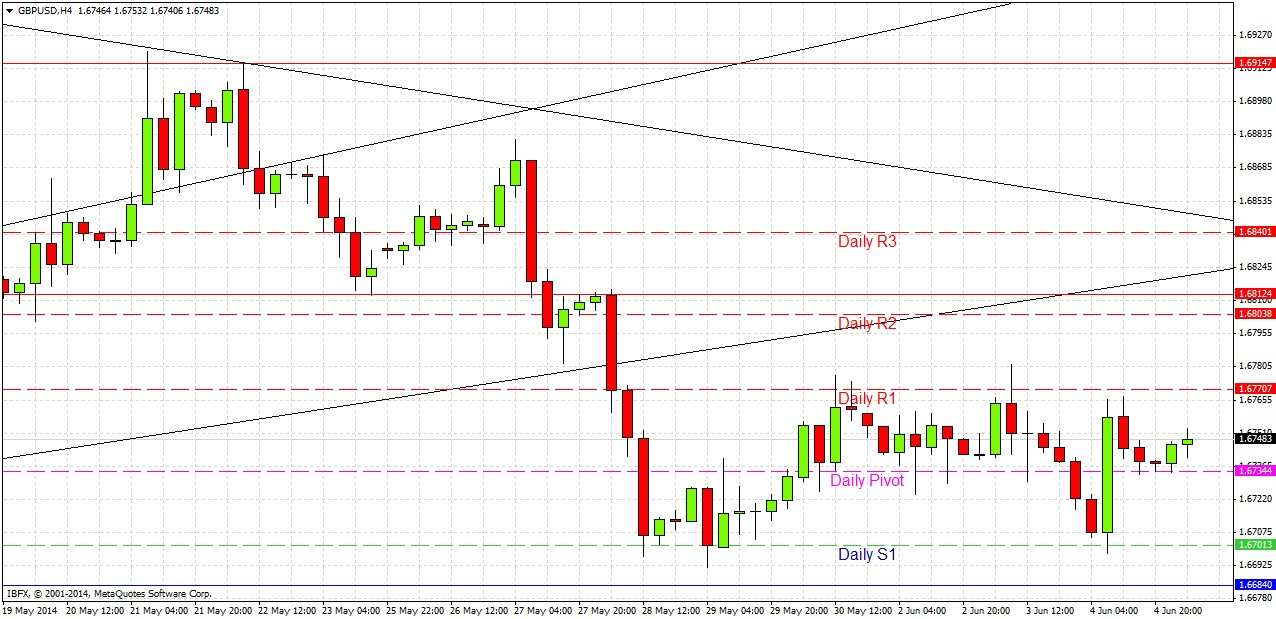

GBP/USD Analysis

This pair has done little for the past six trading days. The major reason for this is that there were important economic data releases approaching which the market was waiting for, and these releases begin today and end tomorrow with the U.S. Non-Farm Payrolls data.

Therefore there is really little new to say about this pair at all. We should maintain a bearish bias.

The key technical levels I was talking about last week have not yet been touched and should be good for trades as so much time has built up during this ranging period. There is 1.6684 below and 1.6812 above. I am a little concerned about 1.6684 as the price has twice come very close to it, so the buying down there may be a little used up. Taking a long from there should only be done very carefully and conservatively. I am far more optimistic about 1.6812, especially as this fits the bearish bias.

At Noon London time the Bank of England will declare the GBP’s official bank rate and asset purchase facility rate followed immediately by a rate statement. Also at 1:30pm there will be the release of U.S. Unemployment Claims data. There is likely to be some volatility in this pair beginning a little before Noon London time.