Gold had an extremely and unusually quiet day of trading the first day of this week. Towards the close of Monday’s London session the price had barely moved, sticking within a range just greater than $5. It was a very quiet day almost across the board with public holidays in a few European countries, so the quiet market was not completely unexpected.

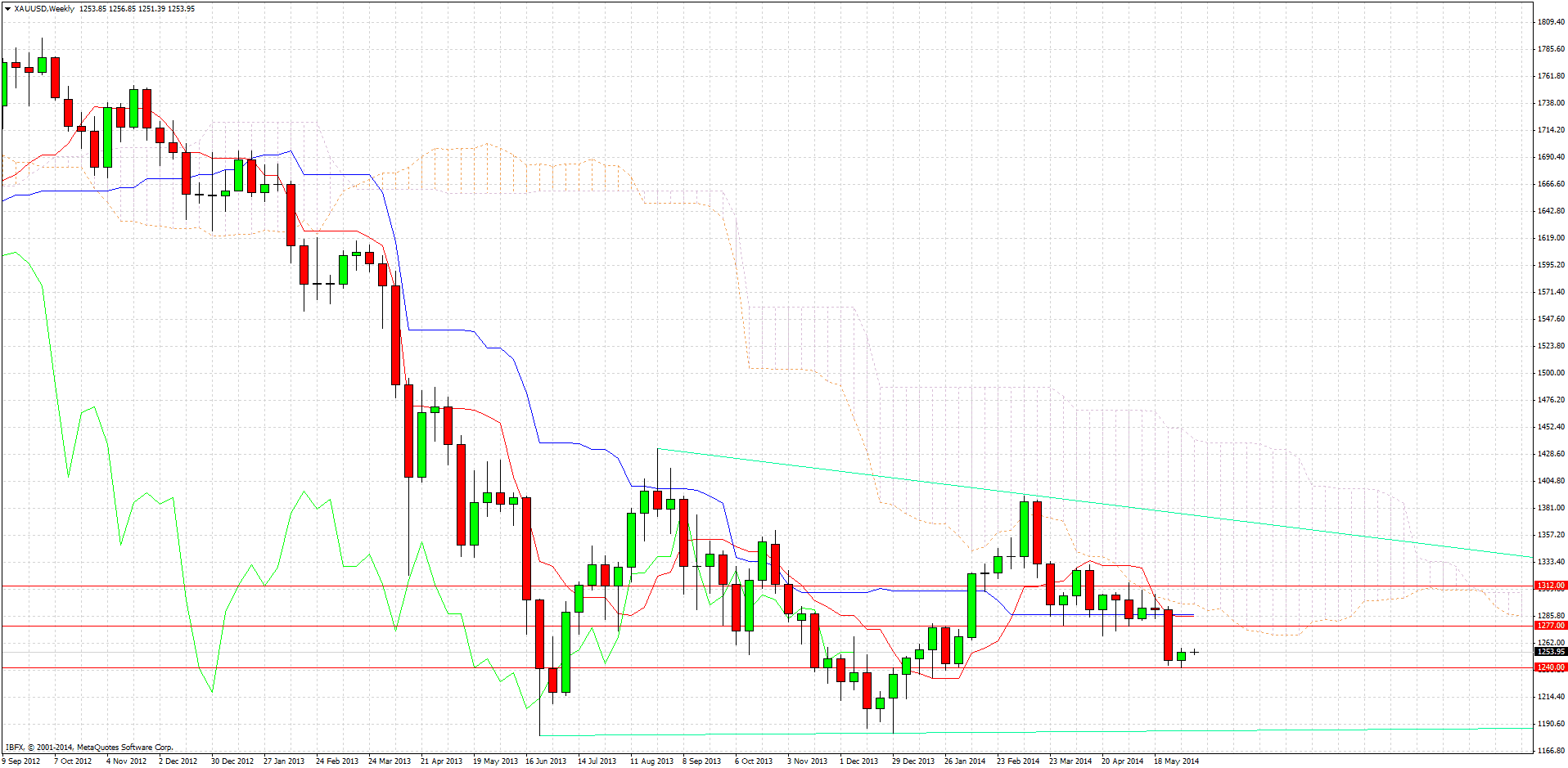

The bigger picture shows that Gold has been trying (but failing) to really penetrate into the Ichimoku cloud above, as can be seen on the weekly chart shown below. The price is a little waterlogged within the lower end of a support to resistance range between 1240 and 1277.

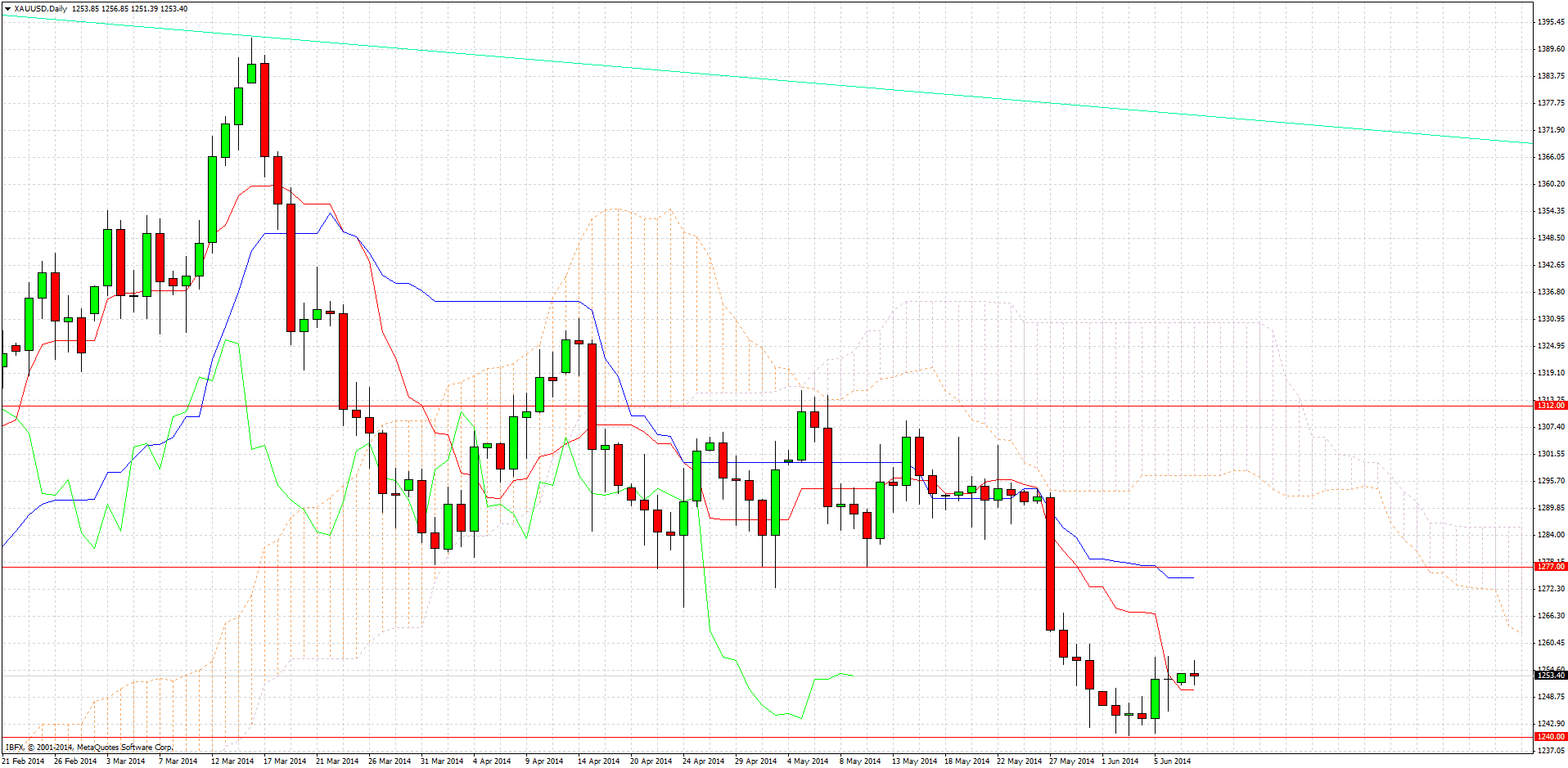

Using the daily chart to take a closer look does show that although we have overall bearishness, there are a few signs that the next short-term move could be upwards. The chart below shows that although we are also below the Ichimoku cloud on the daily time frame, price action right now is looking a little bullish, with the failure to penetrate below 1240 over a few lower-wicked days, before the strongly bullish engulfing candle printed last Thursday. This has not exactly broken upwards, but the price has held up reasonably well from here, and there are probably plenty of orders at around 1277. Selling at around 1275 looks like a tempting proposition.

On the other hand, a sustained break below 1240 could see a fall all the way down to the near-horizontal bullish trend line and support that could be expected to kick in more or less at the round number of 1200.