The XAU/USD pair closed yesterday’s session lower than opening but remained within the previous two days’ trading range. Wednesday’s data from the world's biggest economy were mixed. The Institute for Supply Management’s non-manufacturing PMI came in stronger than expected with a print of 56.3 but the Automatic Data Processing Research Institute said companies added only 179K workers in May, less than expectations of 217K. Keep in mind that ADP’s numbers aren’t so reliable predicting the government’s data.

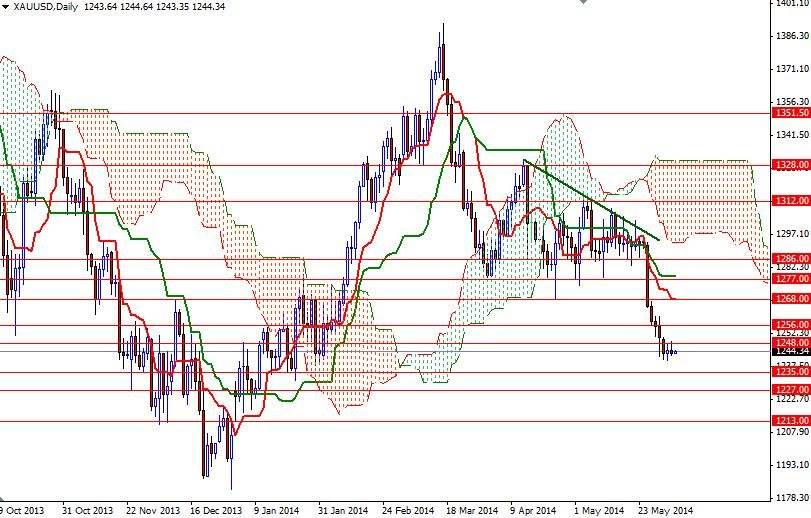

The gold market is understandably calm during the Asian session today. We are stuck in a tight trading range roughly between 1240 and 1248 as investors are waiting for the outcome of the European Central Bank meeting (today) and monthly U.S. non-farm payrolls report (tomorrow). From a technical point of view, the weekly and daily charts will remain bearish while the pair is trading below the Ichimoku clouds. We also have bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on both charts.

Because of that, I expect the area between 1268 and 1277 -which acted as both support and resistance in the past- to play an important role going forward. But of course, in order to reach that far, the bulls will have to face some hurdles on the way such as 1248/51 and 1256/60. Support to the downside can be found around the 1240 level. If this support gives way, the XAU/USD pair could test 1235. Breaking below that level would clear the path to 1227.