Gold prices (XAU/USD) settled higher on Thursday as comments from ECB President Mario Draghi helped provide a lift to gold. The European Central Bank cut all three main rates yesterday and announced a new liquidity program designed to support lending. The central bank also said officials will start work on purchases of asset-backed securities. Apparently, Draghi delivered more than he had suggested before.

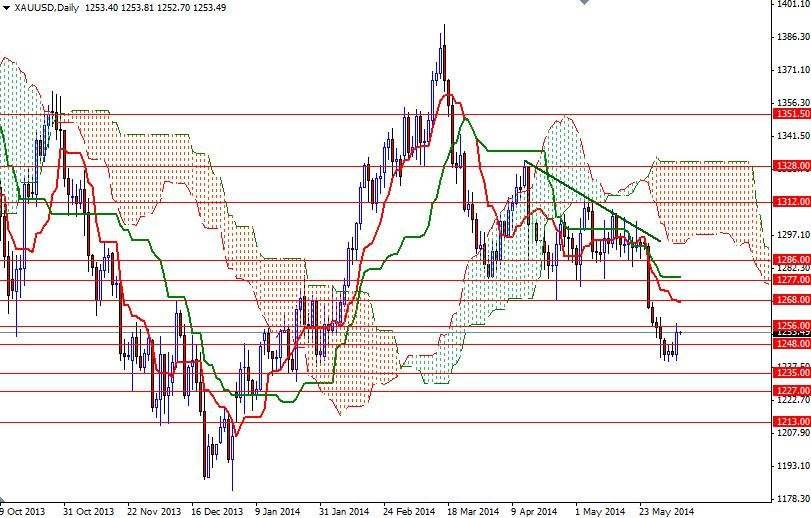

As a result, the XAU/USD pair managed to break above the 1248/51 resistance and tested the 1256/60 area. The XAU/USD is currently trading at $1253.49 an ounce and I will be keeping an eye on the 1248/51 zone today. As I mentioned in the monthly forecast, the market might want to revisit the 1268 - 1277 area (which had held prices and acted as bottom for 8 weeks) before grinding lower. If the bulls manage to break through 1256/60, they will probably be challenging the bears at 1268.

Looking at the long term charts from a purely technical point of view, (and based on the fact that the XAU/USD pair trading below the Ichimoku cloud on the weekly and daily time frames) I think the odds favor further drops. So, until the bearish technical outlook changes signs of weakness are what I am looking for. If the 1240 support level is broken, it would be technically possible to see the market heading back to 1227. Of course, the bears will have to drag prices below 1248/7 in order to approach that support. Today’s jobs report could be the catalyst that both sides need.