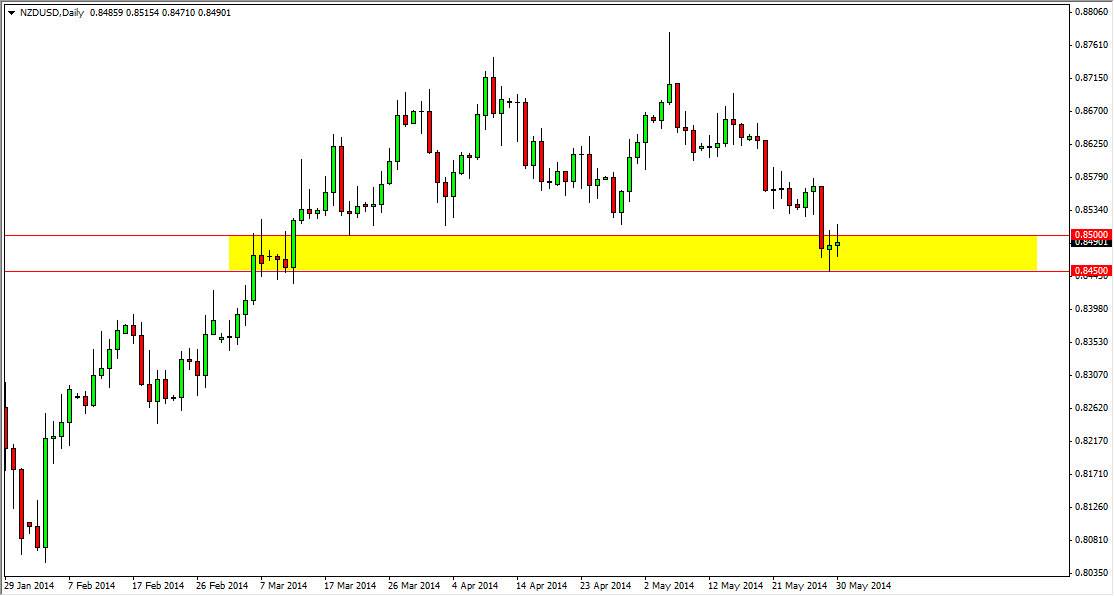

The NZD/USD pair had a back-and-forth session on Friday, as we continue to hang about the 0.85 region. This region extends all the way down to the 0.8450 level as far as I can tell, and is more or less a support zone than a specific level. As you can see by the yellow box on the chart, it is a bit “squishy”, but ultimately I think that the market will find this area to be supportive enough to bounce. If we break above the top of the candle for the Friday session, I believe at that point time we will more than likely grind our way back to the 0.87 level again. That is the top of the recent consolidation area, and as a result that is the most obvious target in my opinion.

However, we could possibly break down below the 0.8450 level. If that happens, I feel that we will more than likely head down to about 0.8350 or so, and possibly even lower than that. After all, I see the yellow box on the chart as a major support area, and I would suspect that the uptrend would be broken at this point in time if we fell below it. It doesn’t mean that the move will be straight down, but it would not surprise me at all to see this market go all the way down to the 0.80 handle, and as a result this is a market that can be sold over and over again.

Commodity markets and general risk.

Paying attention to the commodity markets in the general risk attitude of the markets globally is the best way to go when trading the New Zealand dollar in my opinion. Yes, I recognize that there are economic specifics when it comes to New Zealand at times they can move this market, in reality it is generally used as a proxy for risk by Forex traders. With that being the case, you simply cannot trade this market without paying attention to that. Going forward, I’m a buyer above the 0.8525 region, or seller below the 0.8450 handle.