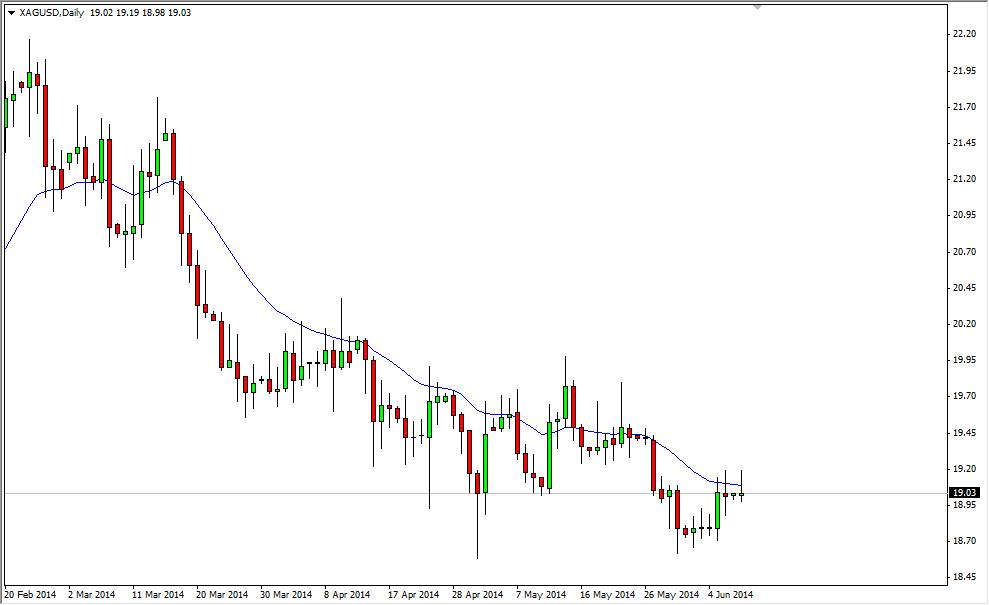

The silver markets tried to rally during the session on Monday, but struggled to hang out above the $19 level during the day. With that, I believe that this market pulling back and forming a shooting star perhaps suggests that we are going to continue to see weakness in this market. For me, if we can break down below the recent low near the $18.60 level, I think that this market can really start to come undone. I don’t know that it will be a straight shot down to $15, but I believe this will more than likely be one of the major targets.

As you can see on the chart, I have the 20 day exponential moving average drawn as a blue line, and we are seeing it as resistance. This candle should continue to show that the sellers are in control, but ultimately this is still going to be very choppy market. I think that silver is going to have a bit of a struggle ahead, but ultimately we could see a very nice buying opportunity for ultra-long-term traders.

Watch interest rates.

Watch interest rates in the bond markets to see the direction of metals, but at this moment it appears that there is a little bit of the divergence as interest rates keep falling. Nonetheless, one of the easiest ways to trade this market is to simply buy options, as the volatility can work against you and the silver futures market gets to be quite expensive at times. If you have the ability to trade the CFD market, that is where I would urge you to go, as you can size your position accordingly.

If we do break above the $19.50 level, we feel that this market will more than likely continue to go higher, but I believe more than likely we will simply grind sideways at the general area we are in right now. For me, I have been buying physical silver in this general vicinity, and will continue to do so every time we fall to a support level. I am hoping to buy a large physical position for my long-term investments, and I believe that I will get that opportunity over and over again. Long-term, I am very bullish the sewer but we could be talking years from now before I let go of it.