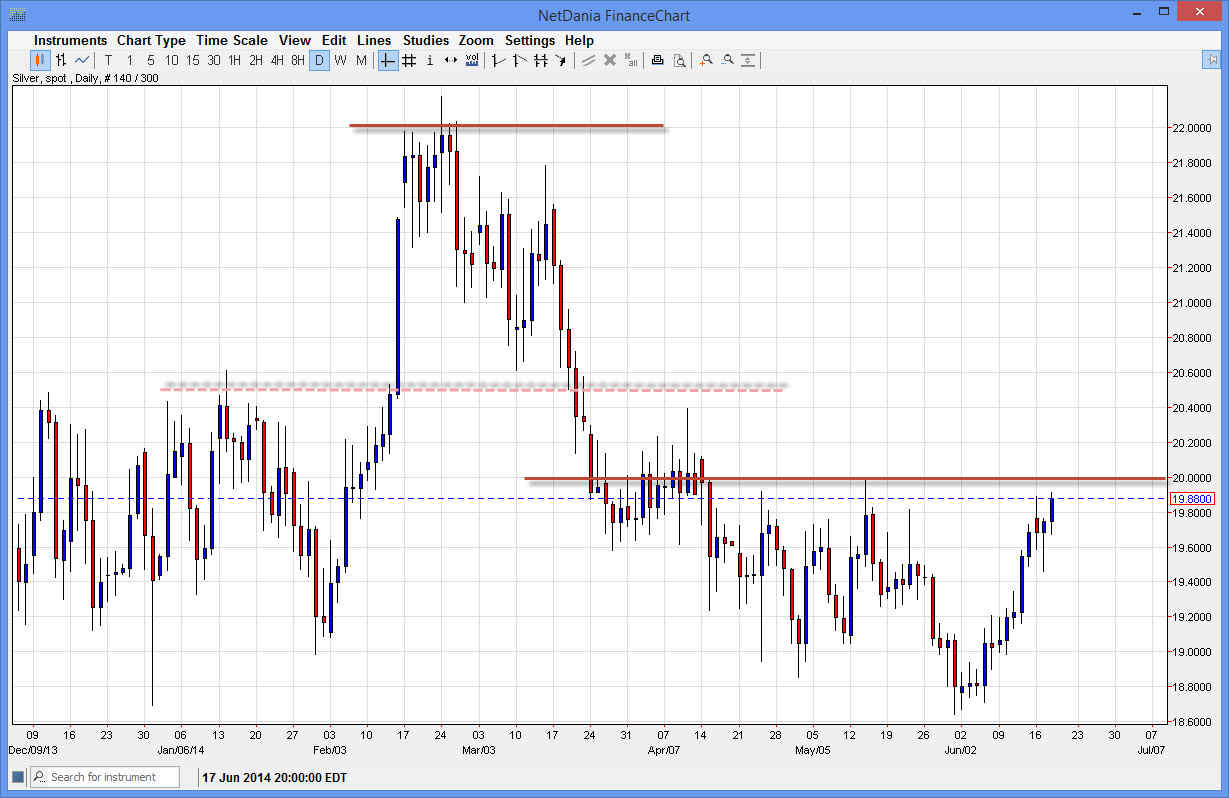

The silver markets initially fell during the session on Wednesday, but as you can see found the hammer from the Tuesday session supportive enough to push the market higher. This resulting candle looks like a market that is ready to try and break above the $20 handle, as of course is a significant resistance level as you can see on the chart. The red line signifies an area where the market has been attracted to several times, selling off every time we have been near it recently.

On top of that, there is an area and the $20.50 level that is resistive as well, as you can see I have drawn a dashed line that signifies the next target if we do break above the $20 handle. The reason it’s a dashed line and a lighter color is that I believe it is a minor resistance area, and that we will ultimately break above there if we can get above $20 in the first place.

Longer-term target.

For myself, I believe that the $22 level is a longer-term target of the summer market, and that we will in fact reach that level given enough time. The Federal Reserve and its meeting minutes during the session on Wednesday suggested that although they are going to taper off of quantitative easing by another $10 billion per month starting in July, the truth is that the Federal Reserve remains fairly loose with their monetary policy, and that should do well for precious metals and hard commodities in general.

Ultimately, I believe that the move does go all the way to the $22 level, but will certainly be choppy. Try playing in the CFD markets if you have the ability, as the futures markets can get very expensive when it comes to silver. On top of that, it allows you to control the amount of exposure that you have, something that I would not want too much of until we clear the $20.50 level. Pullbacks at this stage in the game should continue to be buying opportunities as far as I can see.