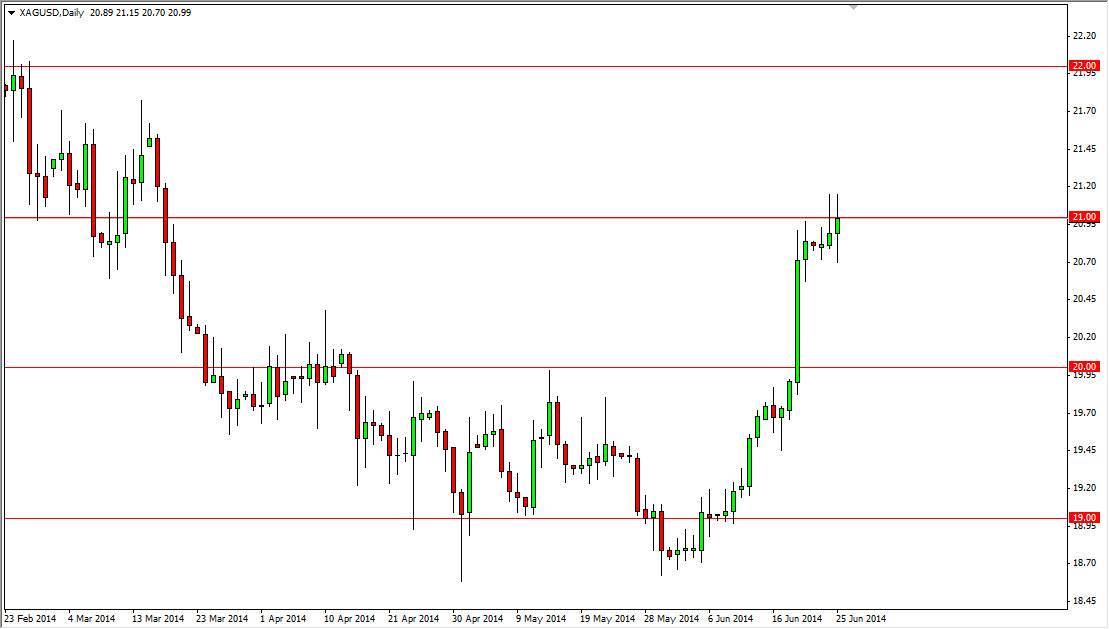

The silver markets went back and forth on Wednesday, as we continue to test the $21.00 level. This level has been resistant, as most recently seen on Tuesday in the form of a shooting star, and as a result it’s very likely that a break above this level could in fact bring in more buyers.

A pullback from here could find plenty of support, especially at the $20.00 level as it is a large, round, psychologically significant number. On top of that, we have already seen plenty of resistance back during the month of March, as well as April and May. The fact that we broke through it about a week ago on a massively impulsive candle suggests that there should be all kinds of support down at that area if we do pullback. In fact, I would love to see some type of pullback to that area and a supportive candle in order to not only buy this market, but to do so with large size.

Bullish and impulsive move.

The move that we have seen over the last couple of weeks has been both impulsive and bullish. With this type of move, it’s hard to imagine that there isn’t some serious buying pressure underneath, and as a result I am very bullish of the silver market at the moment. Because of this, any pullback at this point time simply looks like value to me, and I will not hesitate to take advantage of it. In fact, I believe that the $20.00 level will be the “floor” in this market for the meantime.

To the upside, I see that $22.00 level as massive resistance, and I would anticipate some type of pullback in that general vicinity in order to offer more buying opportunities going forward. Short-term traders will certainly be very bullish and be looking to take advantage of these pullbacks, which is very typical in the futures market. Remember, the futures markets are very highly leveraged, and there are a lot of day traders that frequent them. With that, we believe that pullbacks will be bought up during the day and continue to push higher.