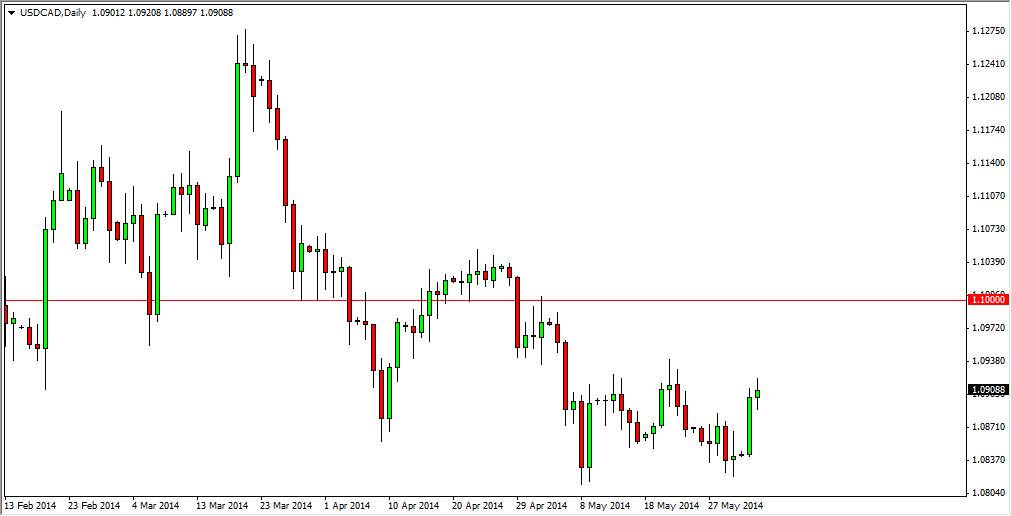

The USD/CAD pair went back and forth during the session on Tuesday, settling on a relatively neutral candle. That being the case, the market looks as if it is struggling with the 1.0950 level. This area seems to be resistive enough that the market will probably struggle going forward as well. It looks as if the market is going to consolidate at this point in time between the 1.0950 level and the 1.0850 level. Going forward, it’s probably can be very choppy, and as a result I’m not that interested in trading this pair for anything more than a short-term trade.

That’s not to say that this is in a tradable pair just that were going to have to look towards short-term charts in order to make any serious gains. That being the case, as you can see I think that this market will more than likely be difficult, but for those of you that can trade rapidly, and could be a very nice set up.

Various barriers.

The market as you can see is consolidating. But if we can break above the 1.0950 high I believe that the market will more than likely try to reach the 1.10 level. Above there, we have the 1.1050 level, which of course is also resistive. Because of this, it appears that the market will more than likely continue to be choppy and short-term dominated, so that being the case I feel that this market should ultimately be one that should be played off of the 15 minute chart, in 50 pip intervals. I think that will be the case going forward, and with that attitude, I believe that little gains of 20 and 30 pips will be available, and will probably remain that way for the foreseeable future. However, we will ultimately make some type of decision, but I don’t see it happening this week. In the meantime though, that’s not to say we can make a few pips here and there, it’s just that we’re going to have to do it in a very choppy and range bound manner.