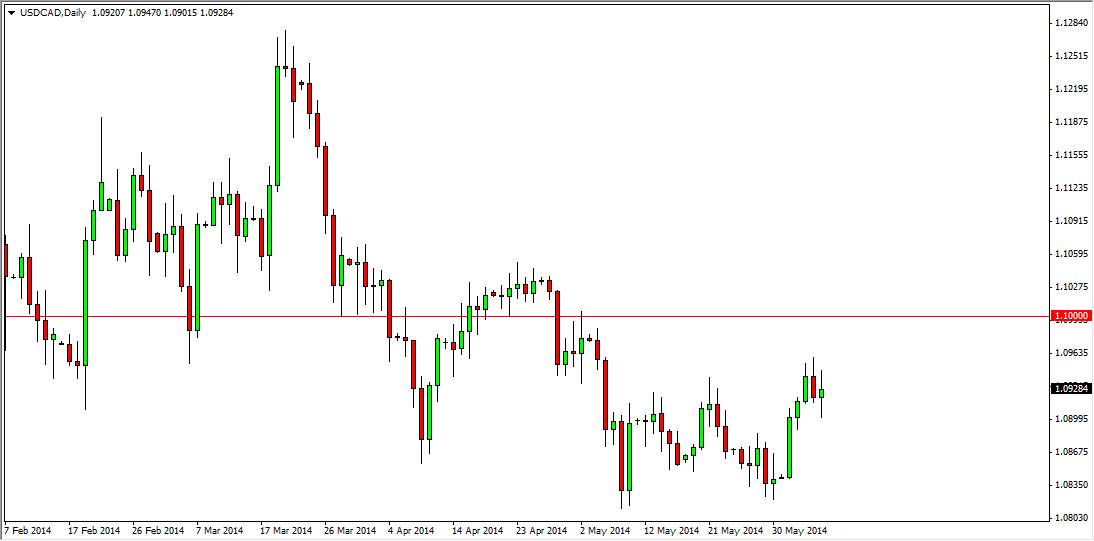

The USD/CAD pair went back and forth during the course of the session on Friday, ultimately settling on a slightly positive candle. This back and forth action would’ve been influenced greatly by the nonfarm payroll numbers of the United States, as well as the employment numbers out of Canada. Essentially it was a fairly mundane day, and most traders would have been disappointed have they been in the market.

It looks as if the 1.09 level will continue to be supportive though, and that is a good sign. I believe that the market will go to the 1.10 handle, given enough time but it will be choppy. It’s above there the things truly get interesting, especially near the 1.1050 level, which opens the door to the 1.1250 level given enough time. On top of that, make sure to pay attention to the oil markets as they tend to have a drastic effect on the Canadian dollar.

A ton of noise below.

I see that there’s a ton of noise below, especially based upon the impulsive candle that we had formed earlier in the week. With that, I have no interest in selling this market right now, and believe that the 1.08 level will be rather supportive. Even if we do fall from here, I will be looking for a short-term supportive candle in order to start buying again. I don’t necessarily believe in Canadian dollar strength, although I recognize that short-term blips in the oil markets could move the Canadian dollar higher or lower.

It appears that the US dollar should gain over time, against most currencies out there. Granted, the Canadian and American economies are so intertwined that I don’t think we are going to see massive moves in this pair. With that, patience will be needed in any trade that you take going forward in the USD/CAD pair. Ultimately though, I believe that even if we break down below 1.08, the 1.06 level might even be a better launching pad for bullish moves higher. Because of this, selling isn’t even an option for me.