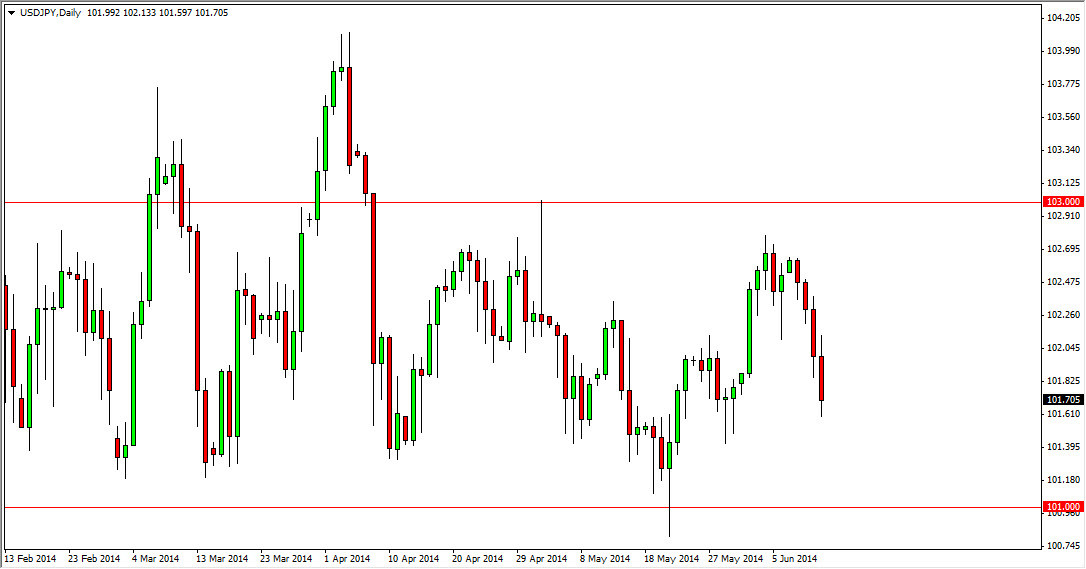

The USD/JPY pair initially tried to rally during the session on Thursday, but as you can see got turned back around and kept falling. We’re closing below the 102 level for the first time in a couple of weeks, and as a result it does look a little bit weak at this moment. However, there is a significant amount of support all the way down to the 101 handle from this area, so I’m not interested in selling this market at the moment. In fact, I’m actually just going to wait on the sidelines for some type of supportive candle in order to start buying.

I believe ultimately that this market is going to at least consolidate, if not get bullish soon. The consolidation area is between the 101 level on the bottom, and the 103 level on the top. I think that the market will continue to be one that we can go back and forth in during the course of the summer, which means it might be a favorite of the short-term trader.

I still have an upward bias though.

I believe that this market still has an upward bias in it, and I most certainly have one. I think that the interest rate differential will certainly come into play sooner or later, but right now the US bond market is still producing very low yields, stifling the growth of the US dollar against the Japanese yen. Because of that, I think the market is going to remain range bound, but you have to keep in mind that the Bank of Japan continues to work against the value of the Yen, thereby keeping this market somewhat static. However, eventually norms will come back into play, and I believe that this market will breakout to the upside. Is because of this I much more comfortable taking positions down near support as opposed to selling near resistance. That way, if I get a surprise of more than likely going to be a positive one as we breakout of the range and continue going higher while I am long.