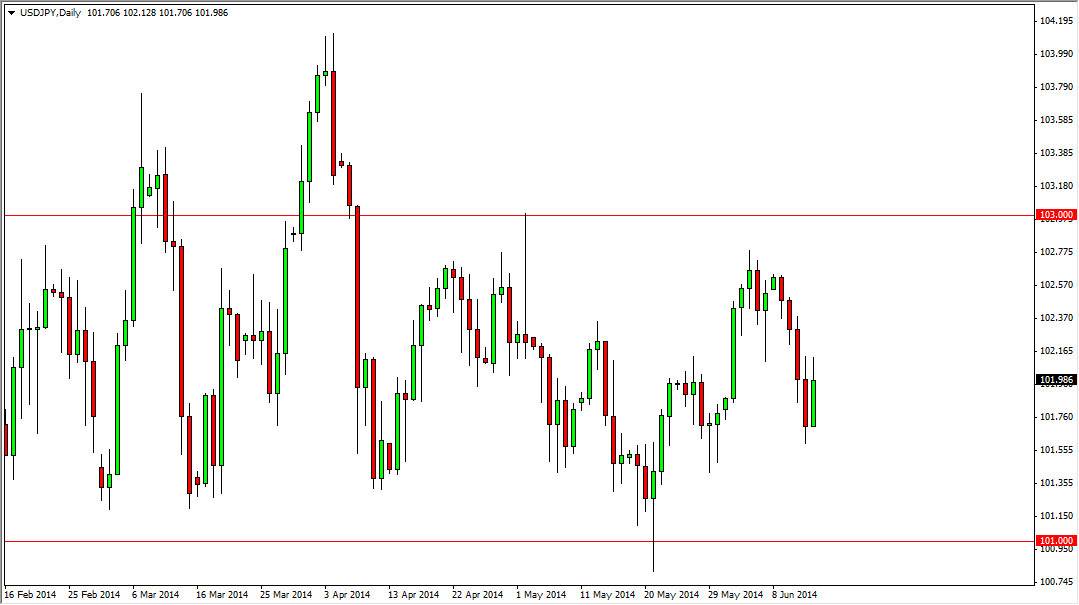

The USD/JPY pair rose during the course of the session on Friday, testing the 102 level which had previously offered resistance on Thursday as well, and also many other times during the course of the year 2014. With that being the case, I think that this is essentially “fair value” at this moment in time as we have been bouncing around between the 101 and 103 levels. The consolidation area has been rather decisive, and with that being the case we feel that the market should continue to hang out in this general vicinity, as we have seen such a strong definition of where the market is continuing to hang about, ultimately the market should be a bit of a short-term trader’s paradise.

The fact that the 102 level has shown resistance again suggests to me that we ultimately will continue to chop around, and that a longer-term position is almost impossible to take on in this pair. Ultimately though, the market should make a decision one way or the other, but I believe that it might be after the summer is over.

The Federal Reserve and Bank of Japan will continue to be the main drivers.

The market should continue to be driven by the 2 central banks, with the Bank of Japan continuing a very loose monetary policy, with the hope of devaluing the Japanese yen. With that being the case, when you look at the other side of the Pacific you see that we have the Federal Reserve tapering off of quantitative easing. The market will continue to pay attention to economic numbers coming out of the United States, as it can lead the Federal Reserve and its decisions about monetary policy.

The tighter the policy, the higher the interest rates in the American bond markets. (In theory.) The higher interest rates will eventually lead more money to leave Japan and head to America looking for higher returns. The money ultimately will flow from East to West over the long term, and as a result the US dollar should continue to gain over time. In the meantime, we are range bound – might as well take advantage of it.