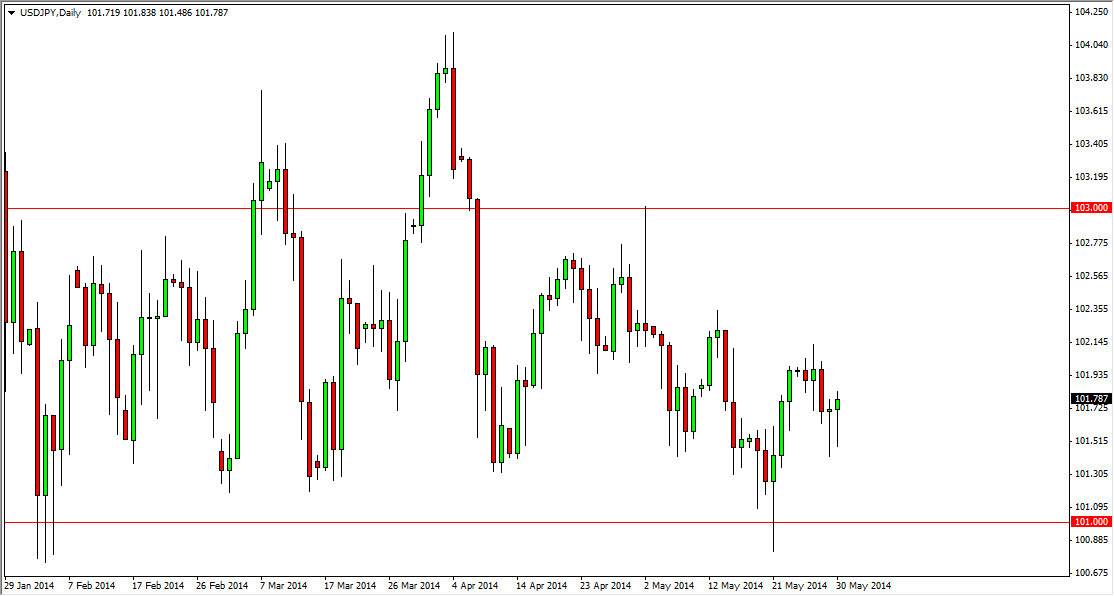

The USD/JPY pair fell initially during the session on Friday, but just as it did on Thursday, we found buyers towards the end of the day which push the market back up to form a hammer. The hammer of course is a positive sign, and the fact that we have seen one line the last 2 days tells me that there is a significant amount of buying pressure below. On top of that, the market has been in a consolidation area for some time now, with the 101 level just below been supportive, and the 103 level above being resistive.

There is a lot of noise in this market though, so you should not be involved in it and less you are willing to hang on to the trade through a lot of volatility. With this being the case, expect a lot of “weak hands” to be flushed out, therefore extending the market with even more choppiness.

Interest rate differentials will eventually favor the US dollar.

Eventually, the interest rate differential between the 2 currencies will expand, and it should favor the US dollar. This is going to be exacerbated by the fact that the Federal Reserve is stepping out of the bond market, and that should bring in less demand, meaning more yield will be needed. On the other hand, the Bank of Japan is continuing to work against the value of the Yen, and as a result I anticipate that the bank will in fact do something to the value the Yen and keep rates low. With that, it’s more than likely going to be a market that will ultimately take off to the upside, something that the Bank of Japan desperately needs as Japan and its export economy suffers from a highly valued Yen.

Going forward, I think that the market will ultimately break above the 103 level, heading to the 104 level. With that, I believe the next several of course is 105, and ultimately 110. This is the beginning of a longer-term move higher as far as I can see, and as a result I am in “buy only” mode.