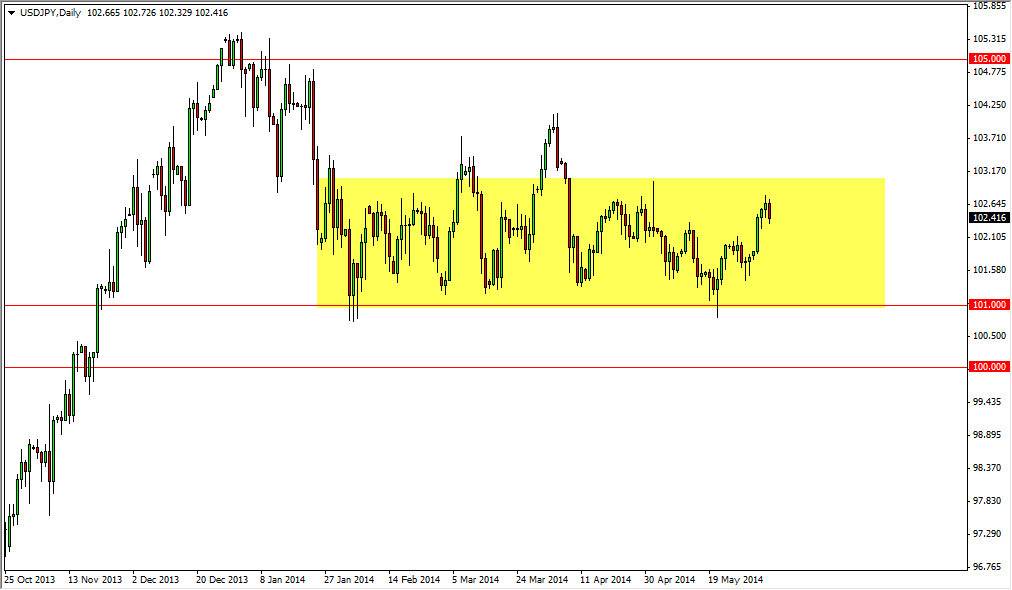

The USD/JPY pair fell during the session on Thursday, as the 103 level above looms large. That is an area that extends quite a bit of resistance, and as a result it’s not surprising to see this market pullback. On top of that, its nonfarm payroll Friday, and that of course will move this market quite drastically at times. I think this is one of those times, and as a result it will be interesting to see what the reaction of the market is to this announcement.

I believe that a pullback will more than likely give us a buying opportunity someplace lower, but certainly by the time we get down to the 101 level as it is massively supportive. With that, I am looking for some type a supportive candle. On the other hand, if we get a break above the 103 level, I think the market will go to the 104 level, and then ultimately the 105 level. However, I need to see a daily close above 103 as this pair tends to be very volatile during this announcement, and false breakouts are fairly common.

Interest rate differential and the labor market.

I believe that the interest rate differential will follow the labor market as well, as a stronger than anticipated employment number will more than likely keep the fat tapering off of quantitative easing. Ultimately that should bring rates back up in the United States, which should invite a lot of buying of US dollars. The Bank of Japan on the other hand continues to work against the value of the Yen, and interest rates as it tends to drive down demand.

Nonetheless, at the very least I think this is a market that can be bought over and over, as we hit the lower part of the consolidation. I think that longer-term this market does go much higher, but it might take a while to get there. Also, there is the possibility that the region between 101 and 103 could simply be the “summer range” as liquidity starts to drift off.