USD/JPY Signal Update

Yesterday’s signals expired without being triggered as the price never reached either 101.13 or 102.40.

Today’s USD/JPY Signals

Risk 0.75% per trade.

Entries may only be made between 8am and 5pm then from Midnight to 7am London time.

Long Trade 1

Go long following bullish price action off either of the broken bearish trend lines currently sitting at around 101.07.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 101.50.

Remove 25% of the position as profit at 101.70 and leave the remainder of the position to run.

Short Trade 2

Go short following bearish price action off the bearish trend line currently sitting at around 102.36.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 102.20.

Remove 50% of the position as profit at 101.75, or take all of the risk off the trade if it is more than 50% of the position size, and leave the remainder of the position to run.

USD/JPY Analysis

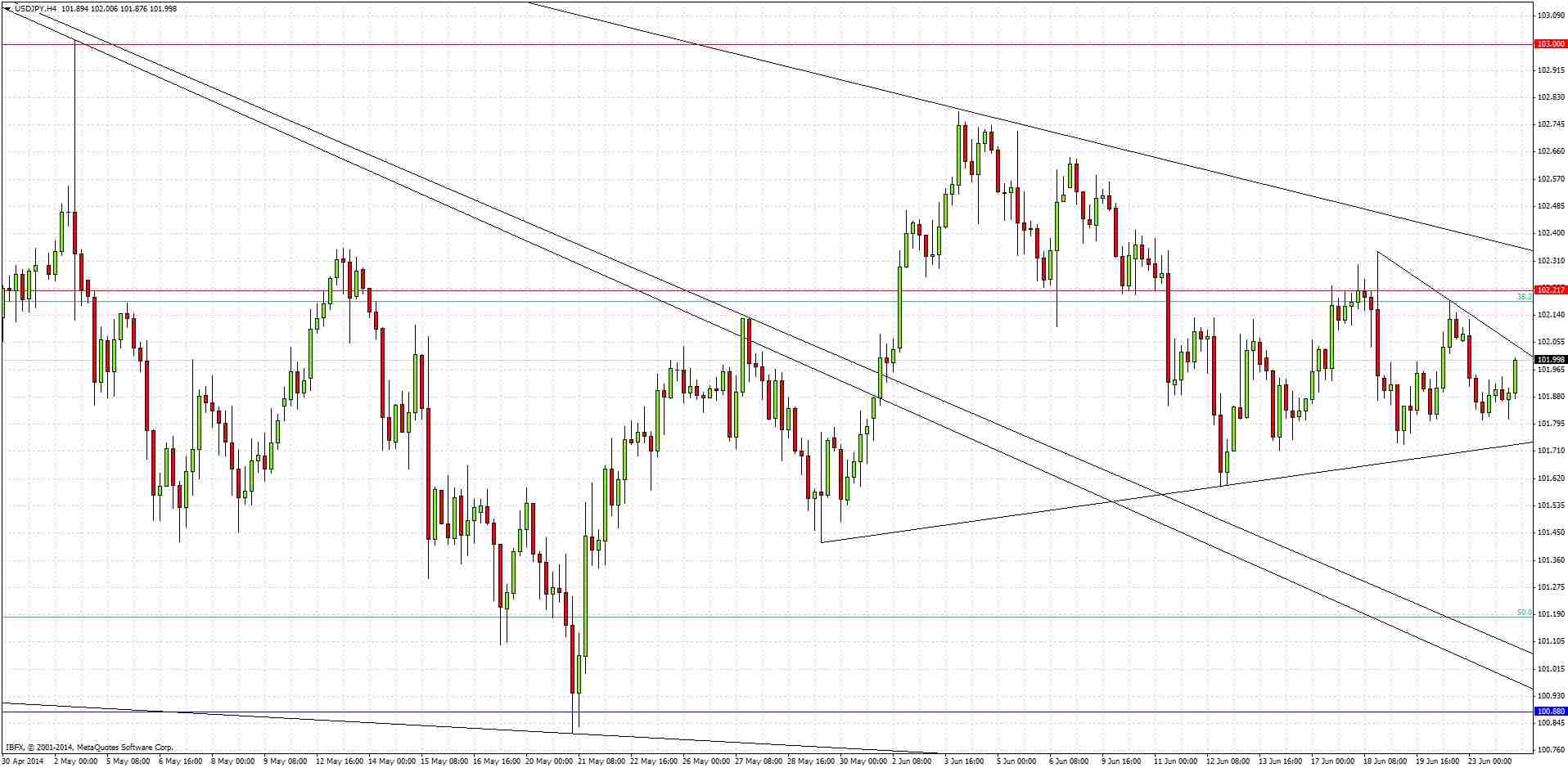

This pair is forming a narrowing ranging triangle which is entirely between the two support and resistance levels highlighted above. There is also a more minor level that is above us and within the triangle at around 102.21.

We will have to break out of the triangle at some point relatively soon, and there is a bearish inner trend line that we are currently approaching that is likely to provide a clue as to which way things are eventually going to go. However, we might remain ranging within the larger triangle for a while yet.

As the bearish major triangle trend line looks to be the strongest trend line of the triangle, it is only there that I am looking for a short trade, it that will be confirmed by bearish price action.

I am also ready to look for a long trade down at the original broken bearish trend lines that are currently close to 101.07.

A strong breakout of the larger triangle, followed by a pull back to the broken trend line, could also provide a good opportunity.

It is quite likely nothing will happen today and we will have to wait a while longer for any good opportunities.

There are no high-impact news releases scheduled for today that will directly affect the JPY. Later at 3pm London time there will be a release of US CB Consumer Confidence and New Home Sales data, which may affect the USD.