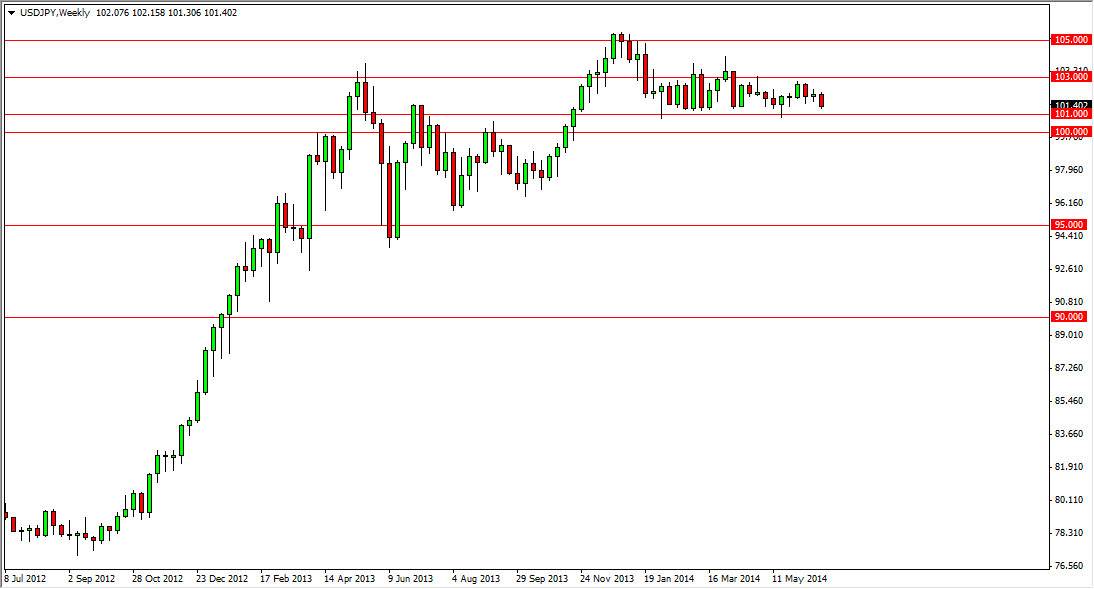

The US/JPY pair continued to hang about in the consolidation area that we have been in for some time during the month of June. Quite frankly, I don’t really see much changing at this point in time. We are in the middle of summer now, and as such it wouldn’t be surprising at all to see the Forex markets essentially go to sleep with the exception of a few particular pairs. However, this is probably not one of them.

The market essentially hasn’t gone anywhere at all this year, as we have for the most part been in a 200 pips range. The reason for that is, at least in my opinion, is the fact that we have a Federal Reserve that is facing a difficult situation. The negative revisions to the GDP numbers out of the United States of course is not helping the situation further. Granted, the Federal Reserve continues to try to taper off of quantitative easing, but it’s doing so in baby steps. That being the case, there hasn’t been enough to get the bond markets excited about selling US debt, and therefore making interest rates go higher. Remember, this is a market that follows interest rates very closely.

Someday, this market will take off.

Don’t get me wrong, I still believe that this market goes much higher down the road. The problem is we just don’t have anything to make it happen right now. The Bank of Japan continues to try and stoke inflation, but he just can’t seem to find it. With that being the case, I think the market to being rather stubborn, but there is an obvious support level at the 101 handle. I think that the support runs all the way down to the 100 level, and I find it very difficult to imagine that we will break below there. I look at the 103 level as a sign that the market could break to the upside and head towards the 105 handle, and a weekly close above the 103 level for me signals the 105 is being targeted next, and then possibly the 110 level. I believe that we could see this market hit the 110 level between now and the end of the year, but right now it’s being incredibly stubborn.