USD/JPY Signal Update

There are no outstanding signals.

Today’s USD/JPY Signals

Short Trade 1

• Go short after bearish price action on the H1 time frame following a first touch of 103.00.

• Place the stop loss 1 pip above the local swing high.

• Move the stop loss to break even when the price reaches 102.78.

• Take profit at 102.30.

USD/JPY Analysis

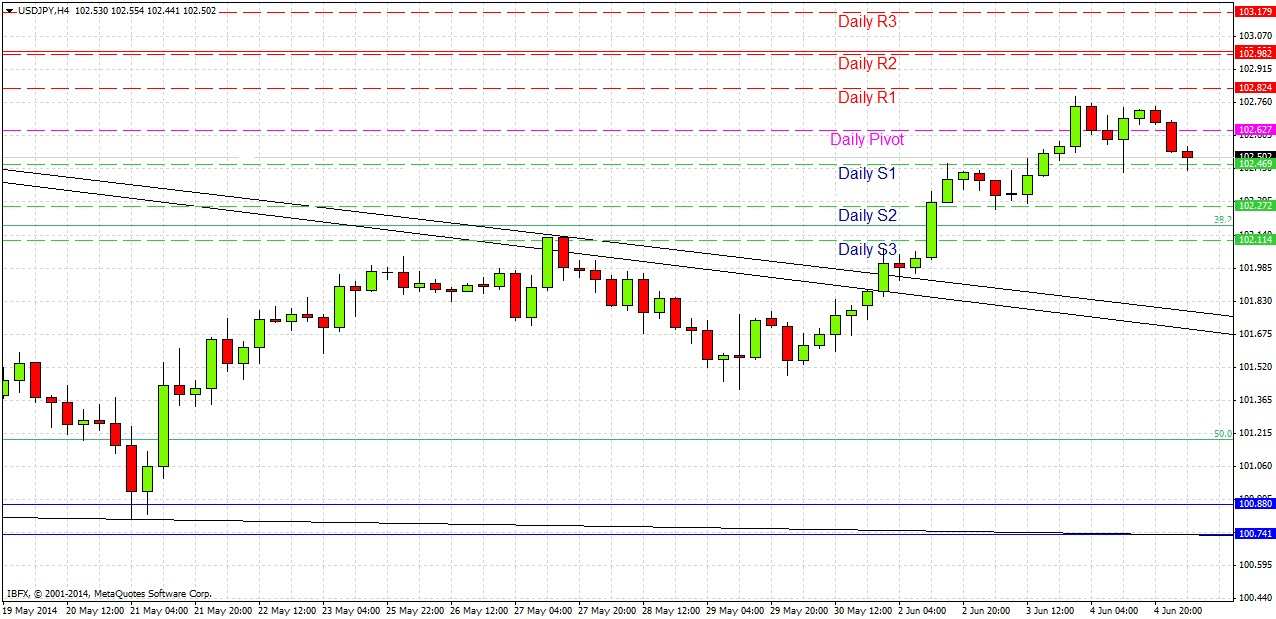

A few days ago we saw a relatively strong breakout from a bearish trend line established since early April. The price proceeded up towards the resistance at 103.00 but seemed to stall yesterday at around 102.75.

So far today, the move has been downwards, with local support at the key psychological level of 102.50 holding the price up. If we get a break down through this level, we might fall quite sharply to retest the broken bearish trend line which is quite some way away. There are no key support levels before that trend line.

On the other hand, if the price does hold up and resume the upwards trajectory, it is quite probably that it will reverse at the flipped resistance at the round number of 103.00, so that should be a good level at which to look for a short trade.

There are no key support levels until 100.88, which is too far away from the current price for us to be concerned with today.

There are no important news releases scheduled today for the JPY. At 1:30pm London time there will be a release of U.S. Unemployment Claims data.