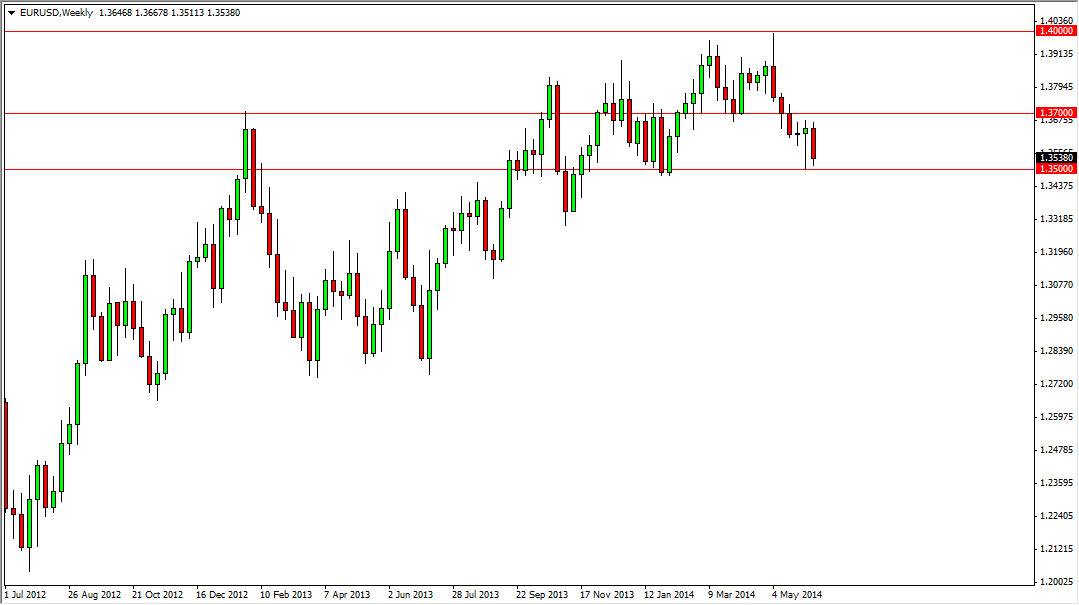

EUR/USD

The EUR/USD pair sold off fairly well during the last week, and is now testing the 1.35 level. This area is significant in my opinion, so I will be watching. However, I don’t see major moves coming either way, as a break below the 1.35 level probably attracts buyers somewhere near the 1.33 handle. On the other hand, I still see the 1.37 level as significant as well. In other words, this is still going to be a short-term market at best.

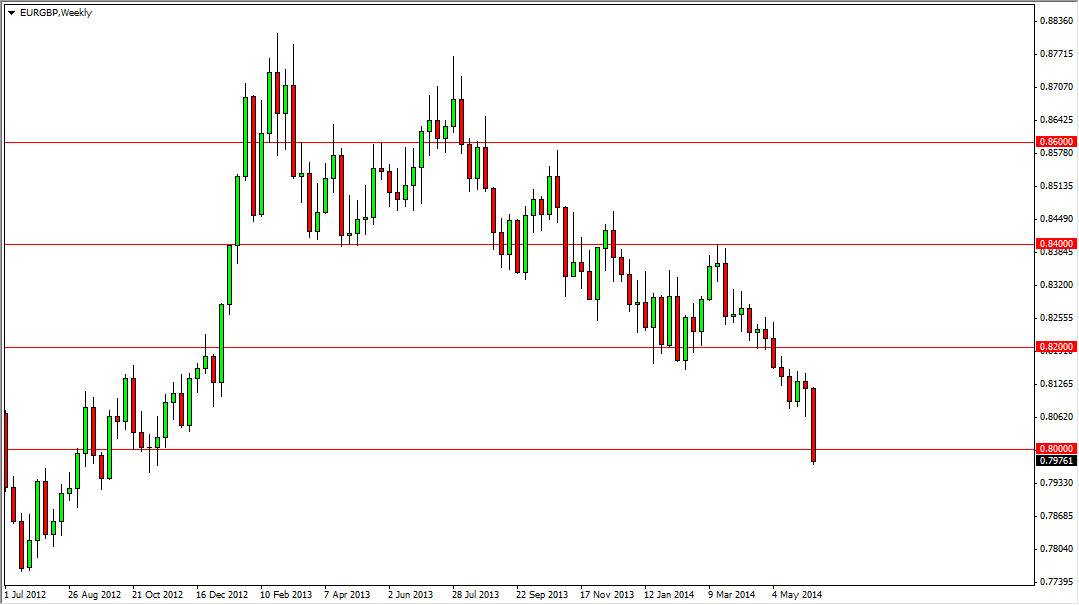

EUR/GBP

The EUR/GBP market broke down during the week, and even managed to close below the vital 0.80 level. This is significant in my mind, as a result I will be selling as long as we can stay below the aforementioned 0.80 level. The 0.78 level will more than likely be targeted now, with perhaps an even lower target in the end. However, if we break back above and close on the daily chart with numbers above the 0.80 level – I am going to simply wait to see if the 0.82 offers a selling opportunity.

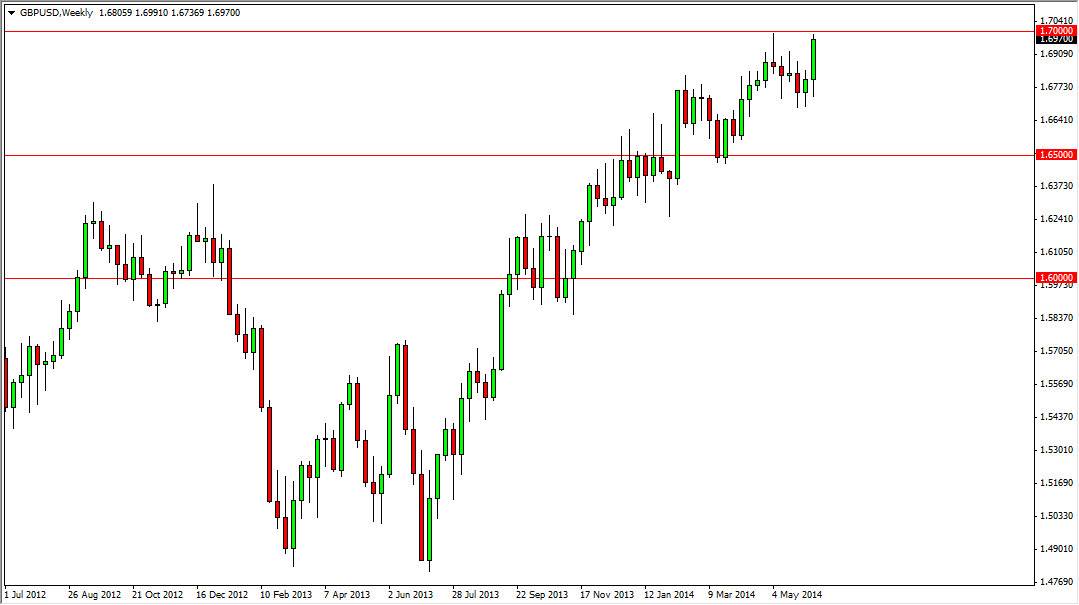

GBP/USD

The GBP/USD pair rose during the week, and slammed into the 1.70 resistance level. The area is the gateway to higher prices, and I think we are getting ready to poke through it. A daily close above that level is enough for me to start buying again, and I think the market should head to the 1.75 level given enough time. If we pull back from here, I think it will simply be the market trying to build up enough momentum to go higher.

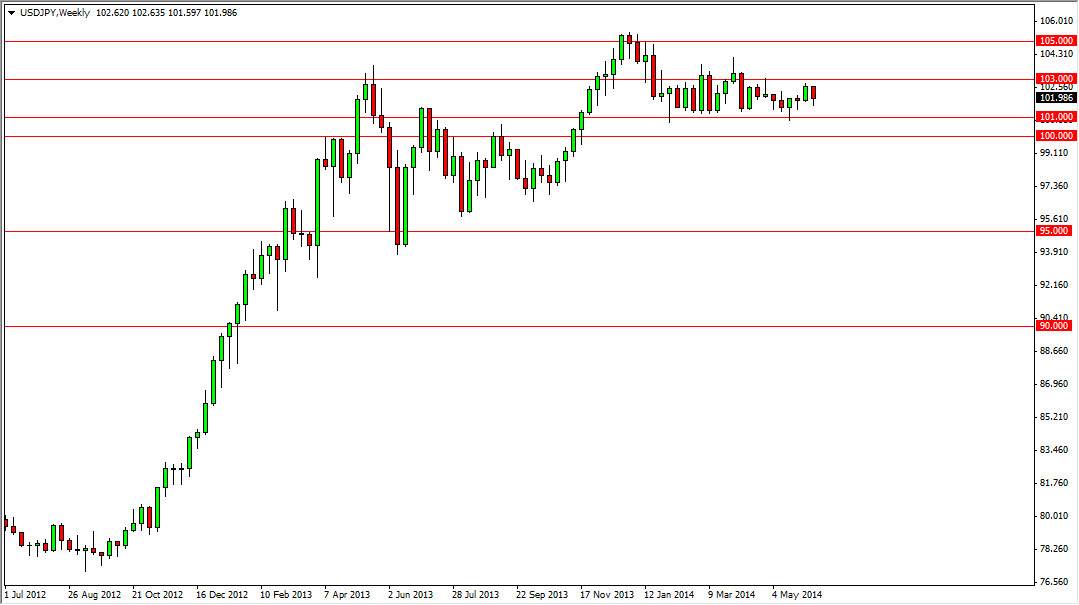

USD/JPY

The USD/JPY pair has been sideways all year, and the past week has done absolutely nothing to change that. We are still stuck between 101 and 103, and until we break one way or the other, it is almost impossible to imagine a longer-term trader getting involved. However, there is the break above a 103 resistance barrier that would have me interested. I think that is where we are going eventually, but until the US bond yields come down, it will be difficult to break out. With this, I am trading this pair short-term only at the moment, but still believe that we are going to see this market go much, much higher.