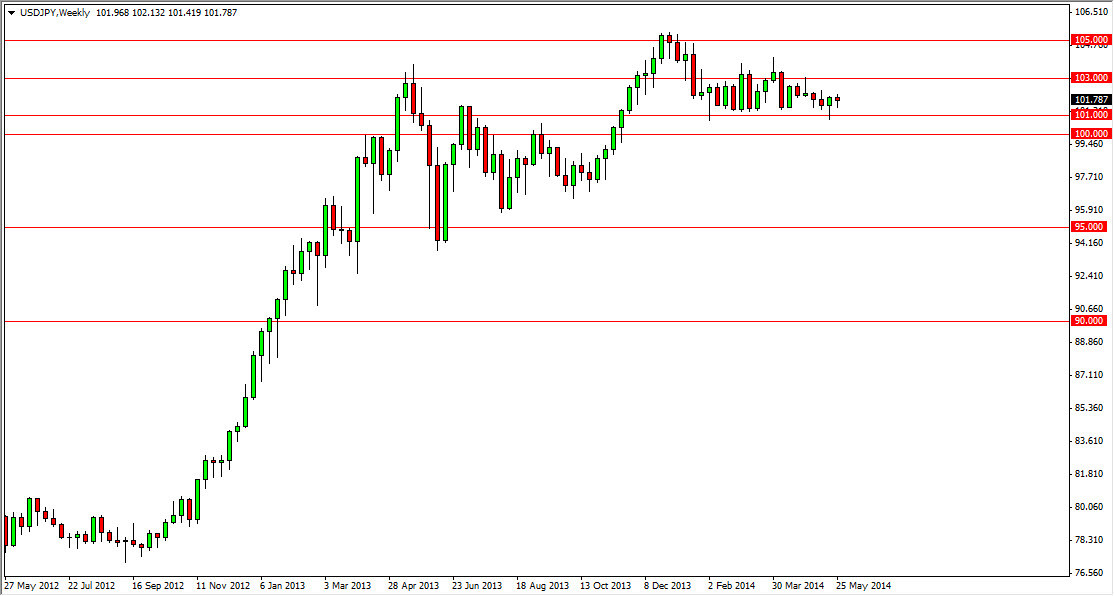

USD/JPY

The USD/JPY pair did very little during the course of the week, as we continue to meander in the same consolidation pattern that we’ve been in. However, I think that this market as well supported by the 101 level, and that the support extends all the way down to the 100 handle. So if anything, I am buying only. I see no reason to sell this market, and I do believe that ultimately we will break above the 103 handle. This is probably more or less going to be a short-term traders market in the meantime, but I am long-term bullish of this pair.

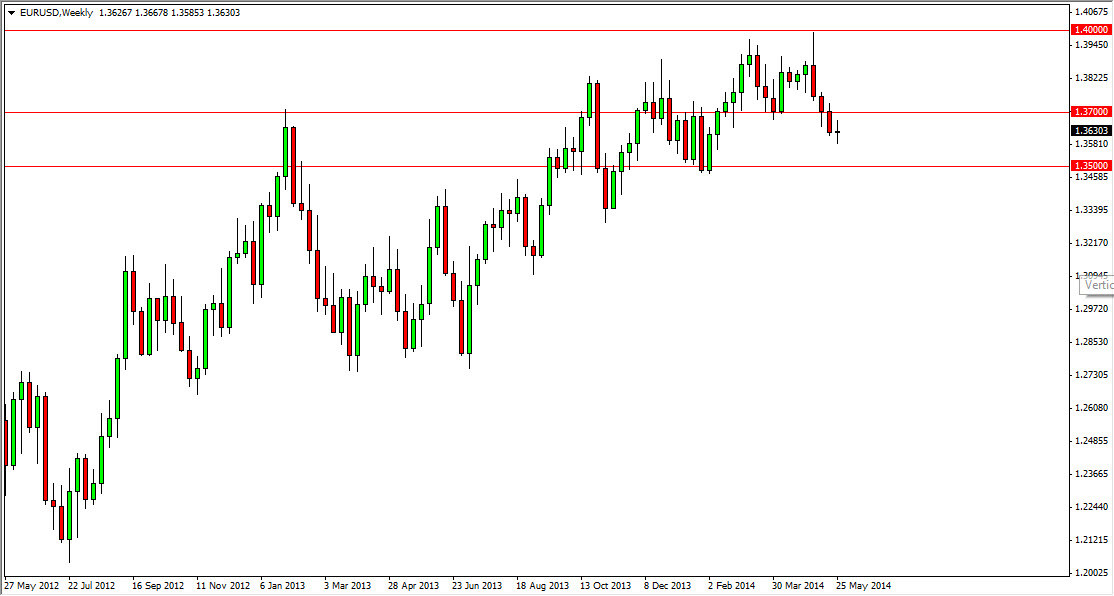

EUR/USD

The EUR/USD pair went back and forth over the course of the week, essentially settling nothing. The one thing that the candle shows is that the 1.36 level has been supportive. That being the case, it is possible we get a little bit of a bounce, but I’m not interested in buying this market until we clear the 1.37 handle to the upside. As far selling is concerned, I think that the 1.35 level will continue to be supportive, and therefore it’s going to be very difficult to sell at this level. The ECB has a meeting on the 5th, and as a result I feel that this is probably a market that’s best left alone until we get that announcement.

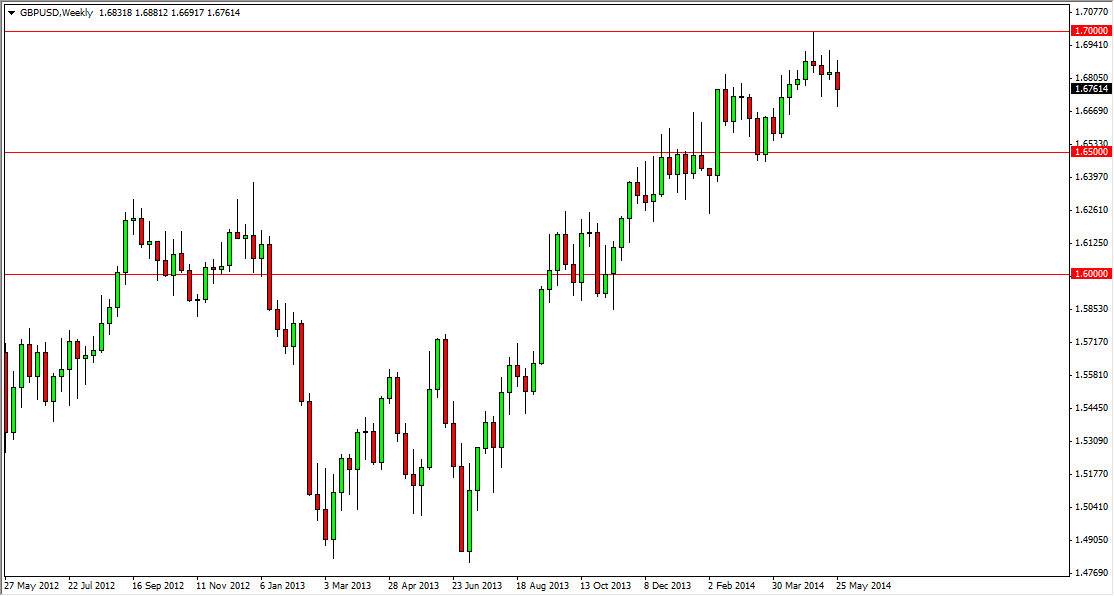

GBP/USD

The GBP/USD pair fell over the course of the week, but at the end of the Friday session we did get a bit of a bounce and evidence that the 1.67 level is in going to be supportive. With that being the case, I feel that this market will ultimately reach the 1.70 level again, and eventually break above that resistance barrier. If that happens, I feel that this will certainly be a longer-term buy-and-hold type of situation as the British pound should continue to gain against the US dollar.

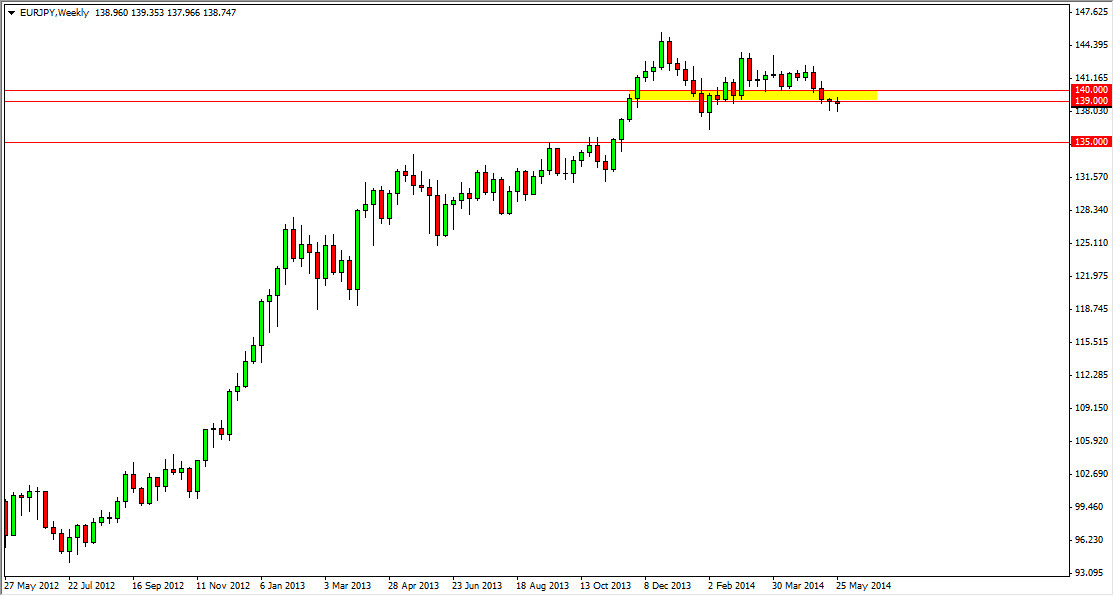

EUR/JPY

The EUR/JPY pair fell during most of the week, but as you can see for the second week in a row, the market formed a hammer at the 139 handle. With that, we believe that this market could very easily bounce as having these candles form one after another shows a significant amount of support. I believe that the 140 level above is the path to the 143 handle, eventually the 145 level. If we do break down below the bottom of these hammers, we could go to the 135 handle. That level is massively supportive, and as a result we would be even more likely to see buyers come into the marketplace, making me even more interested in buying. With the ECB having it’s meeting this week, there’s a good chance of this market reacts violently.