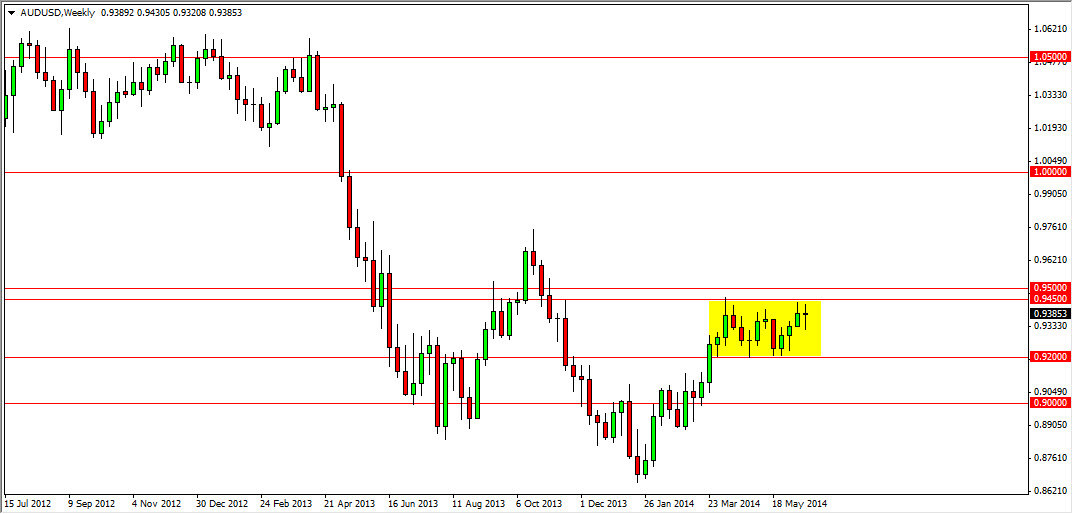

AUD/USD

The AUD/USD pair didn’t do much during the course of the week, and we still remain within the yellow box on the attached chart. We have obviously been consolidating for a few months now, but the fact that we had formed a hammer for the week just below the significant 0.9450 resistance level tells me that there is upward pressure on this market. I believe that if we can get above the 0.95 level, as I believe the resistance to be 50 pips deep, this market could breakout to the 0.9750 level, and then ultimately parity. In fact, that’s essentially what I am banking on, but I do not have a position until we are above the 0.95 handle.

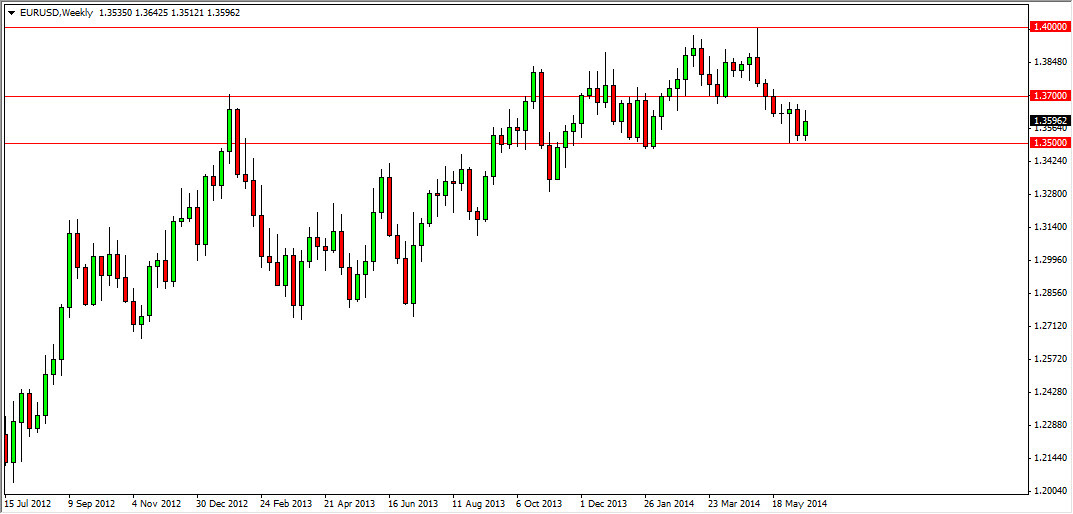

EUR/USD

The EUR/USD pair had a positive week as we continue the consolidation that we’ve seen just above the 1.35 handle. I think ultimately this pair will probably respect that level for support, but regardless it’s almost impossible to trade this market for any real length of time. I think that the markets probably going to be very sideways during the course of the summer, so quite frankly this pair isn’t one that I’m that interested and at the moment.

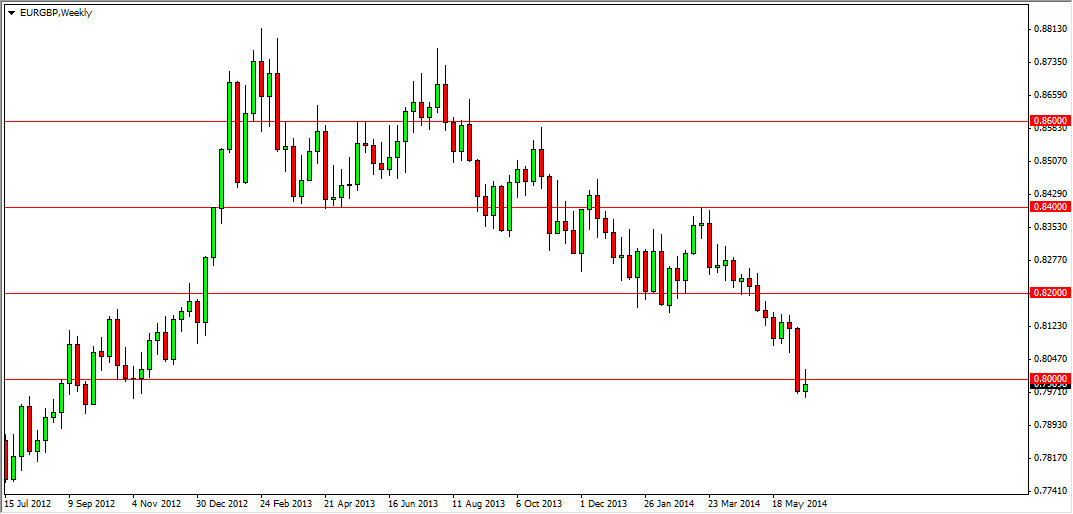

EUR/GBP

The EUR/GBP pair has been in a nice downtrend for some time now. At this point in time, we have broken below the 0.80 handle, an area that I thought would be massively supportive. The fact that we broke down through it, and then trying to retest it for resistance this past week tells me that the selling pressure is still there. The shooting star at the bottom of the downtrend normally means continuation, and on a break of the bottom of this candle I believe that this market will ultimately go looking for the 0.75 handle, but this pair tends to be very slow so don’t expect that move overnight. Regardless, a break lower is definitely a very negative sign.

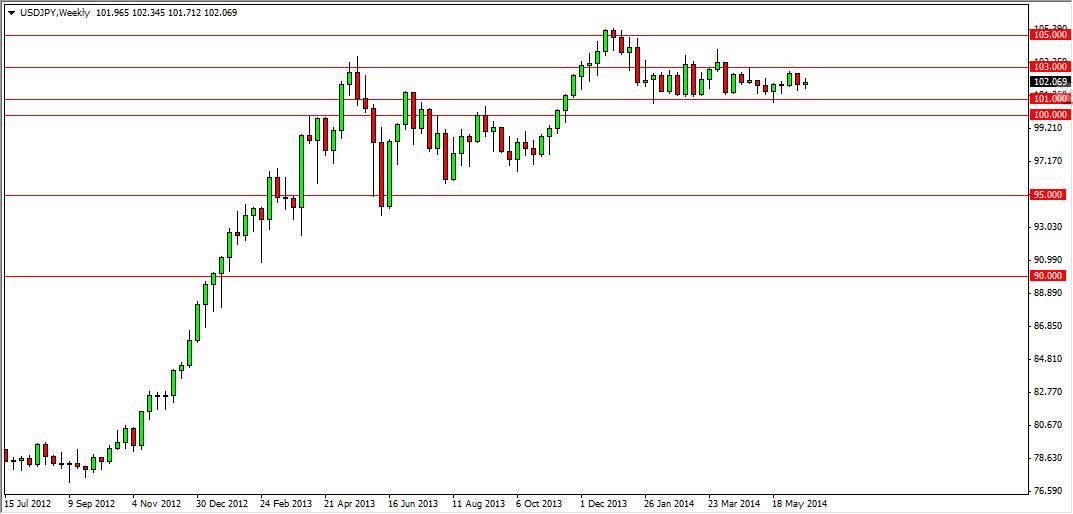

USD/JPY

The USD/JPY pair did very little during the course of the week as you can tell on the chart, and we remain stuck between the 101 and 103 handles. Because of this, I think that this market will be ignored by longer-term traders until we get some type of impulsive move in one direction or the other. I believe that we will ultimately break higher, but the market also looks as if it’s ready to take a bit of a rest for an even longer period of time, as the summer should provide very little in the way of excitement. Watch the 10 year bond yields in the United States, because if they start rising, so will this pair.