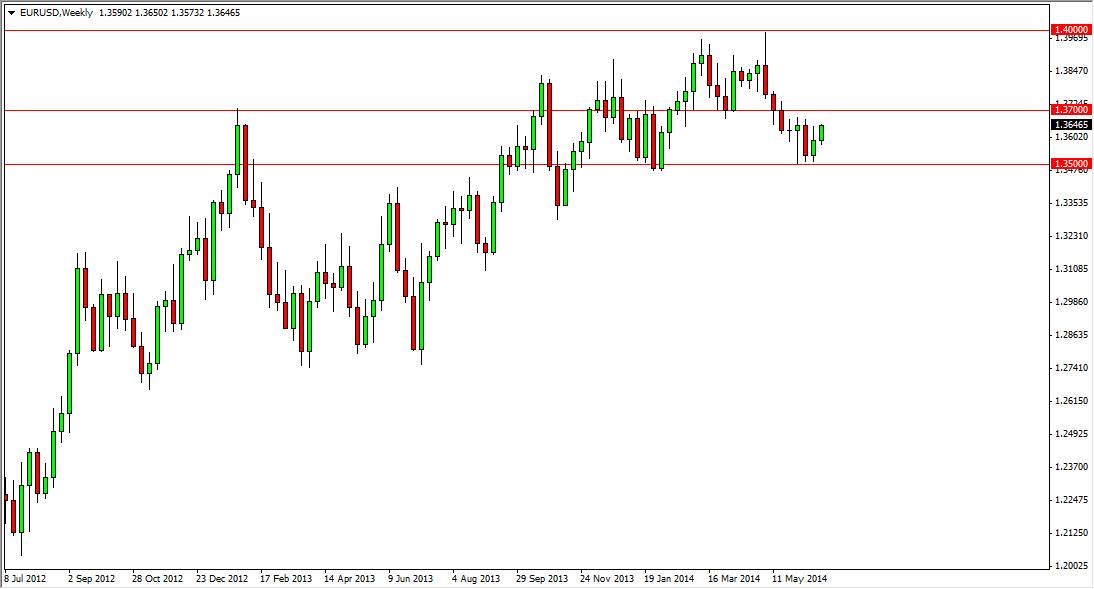

EUR/USD

The EUR/USD pair had a slightly positive week over the last five sessions, but at the end of the day we still are stuck within a fairly tight range, and I don’t really see anything that’s going to change that anytime soon. That being the case, I am absolutely bored with this pair, and am not trading it at all. However, the Euro can be traded against other currencies, which is something you should keep in mind instead of being sucked into the trap of thinking of the Euro as the EUR/USD pair. There are plenty of other currencies out there, and the other pairs are quite often reasonable as far as the spread is concerned.

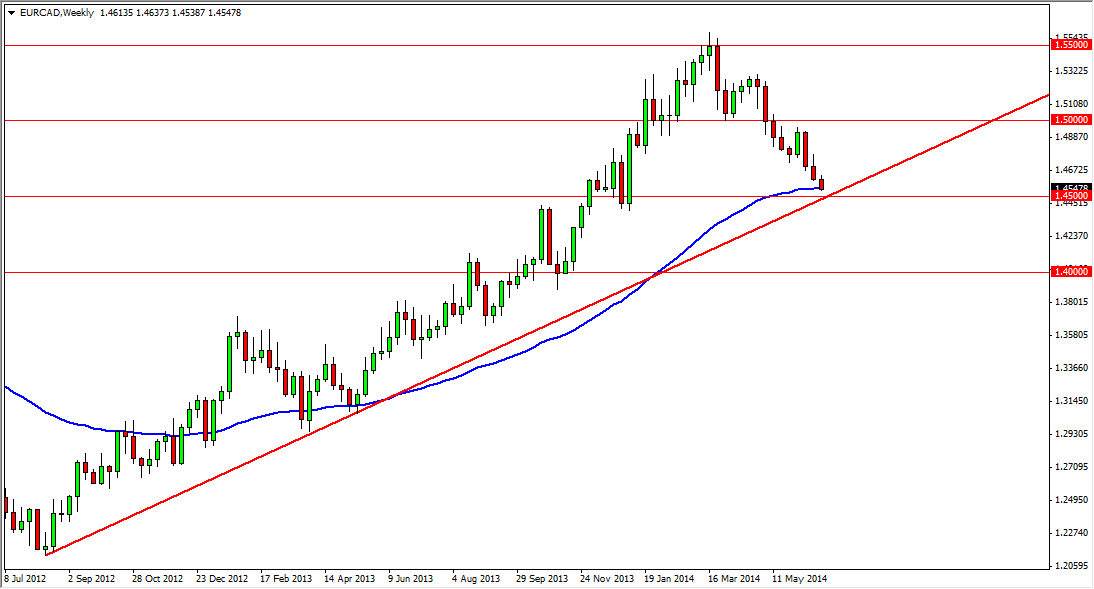

EUR/CAD

The EUR/CAD pair continues to fall, but I think we are going to be seeing a major decision made over the course of the next week. After all, as you can see on the chart there is the 52 week moving average, which of course is the average price for the year, and an uptrend line that we are approaching. The 1.45 level is just below as well, and I think that there is a significant amount of support. If we can bounce from here, this market could continue the uptrend for a longer-term move. However, if we break down below the 1.45 level on a significant breakdown, this market goes to the 1.40 handle. You away, there is a trade coming soon and we need to be paying attention to this market.

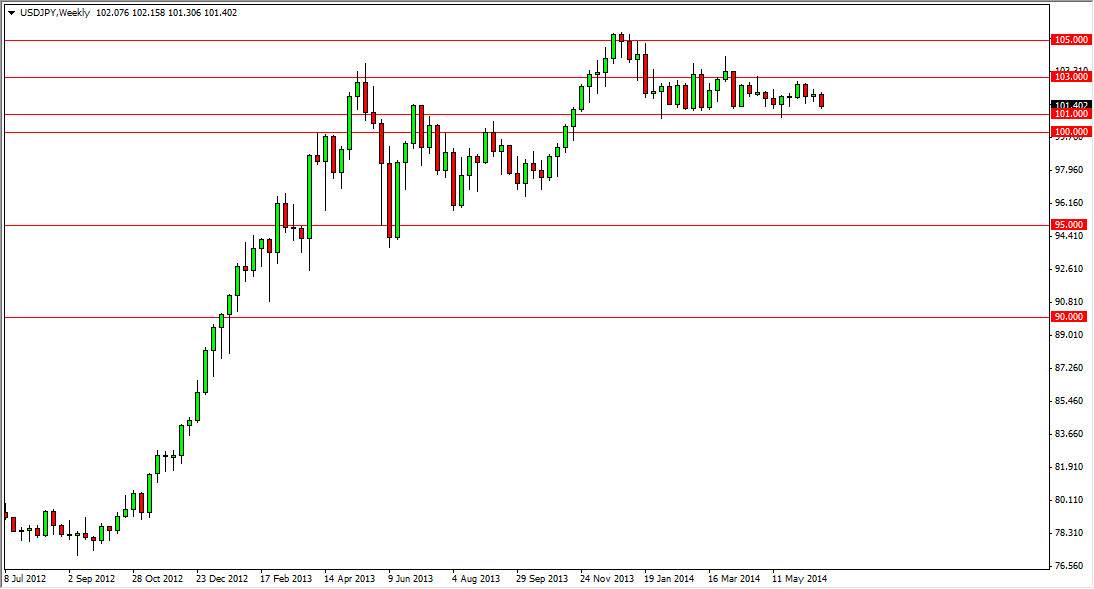

USD/JPY

The USD/JPY pair continues to bounce around in this general vicinity, and as a result I think that this is a market worth watching, but I don’t necessarily know if we go to break out anytime during the next week or two. I think that it’s possible that the summertime will absolutely continue the grind that we’ve seen more and more over this year. However, I do think that if we eventually get above the 103 level, we will bring to the 105 level and then higher than that area. I don’t necessarily have a scenario in which I want to sell this market, I think that there is a massive amount of support all the way down to the 100 level. In the meantime, short-term traders will continue to take advantage of this market, and selling is impossible.

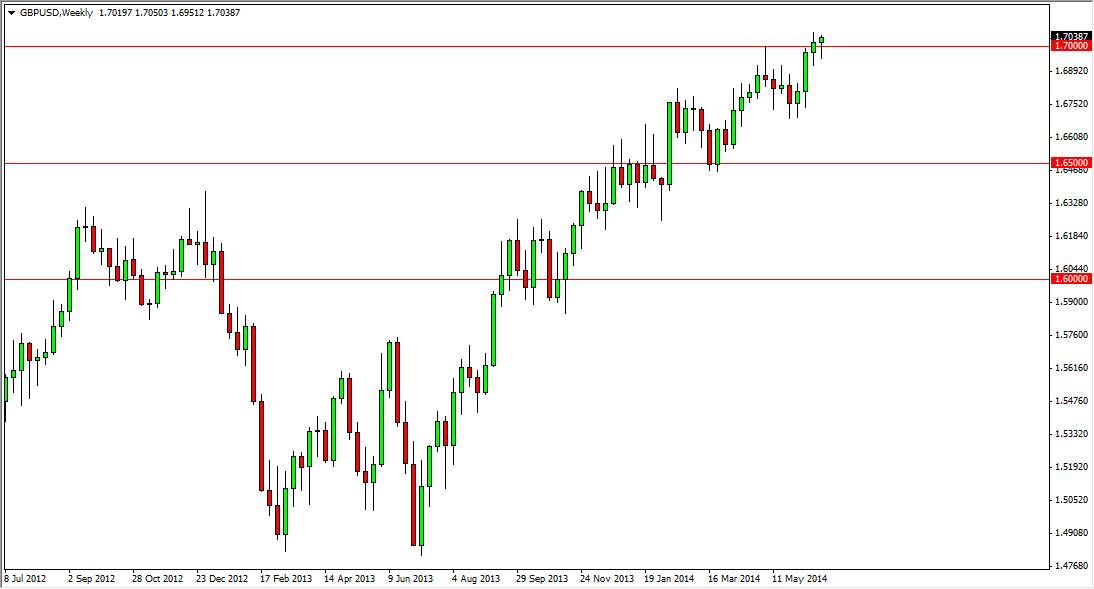

GBP/USD

The GBP/USD pair broke down a little bit during the course of the week, but as you can see we have broken above the 1.70 level. I think that this market is getting ready to break out, and the fact that the United Kingdom is coming out of recession certainly does not hurt the situation. On top of that, the GDP numbers were revised much lower in the United States, showing the slowest amount of economic activity in the last five years. This market should be ready to go to the 1.75 handle, and as a result on a break the top is hammer, I continue to buy this pair.