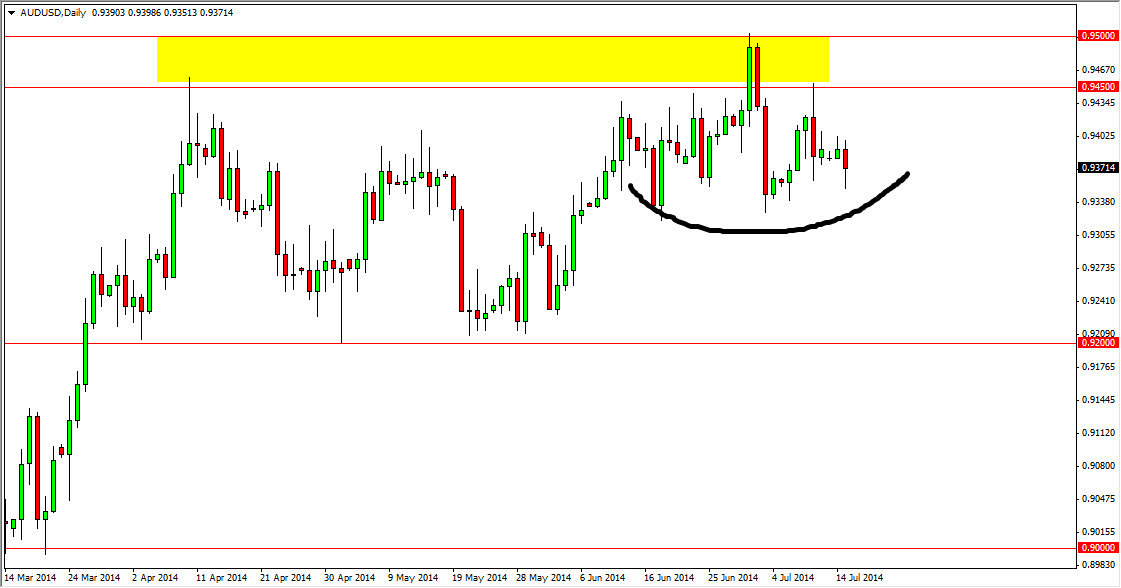

The AUD/USD pair initially fell during the session on Tuesday, but found enough support near the 0.9350 level to turn things back around and form a bit of a hammer. The hammer of course suggests that there is buying pressure just below, and this makes sense as we have seen a bit of a “basing” in this general vicinity. With that, I believe that this market is trying to build up enough pressure to break out above the 0.95 level finally, which I actually see as resistance extending all the way down to the 0.9450 level.

Moves like this take a bit of momentum, so the fact that we are taking our time doesn’t surprise me. On top of that, we are in the summer months now, which of course tends to be a little slower than usual. All that being considered, I think this market is doing exactly what you would expect at this point in time.

The gold correlation could work against this pair though.

Gold markets got hit fairly hard over the last couple of sessions, and that of course is doing the Australian dollar no real favors as there is a longer-term correlation between the AUD/USD pair and the gold futures markets. If the gold markets drop down below the $1280 level, things could get really ugly for the Australian dollar, but at this point in time I believe that both of these assets will have a bit of a bounce in the near term.

If we can get above the 0.95 level, I think that this market has a bright future ahead of it. We could grind our way to the parity level, as it is the next major resistance barrier on the longer-term charts, and a level that the Australian dollar was quite comfortable with for some time. After all, it wouldn’t exactly be a real stretch to imagine that the pair could bounce around parity for some time as well. I have no real interest in selling this pair, at least not until we get below the 0.92 level, something that I do not expect to see anytime soon.