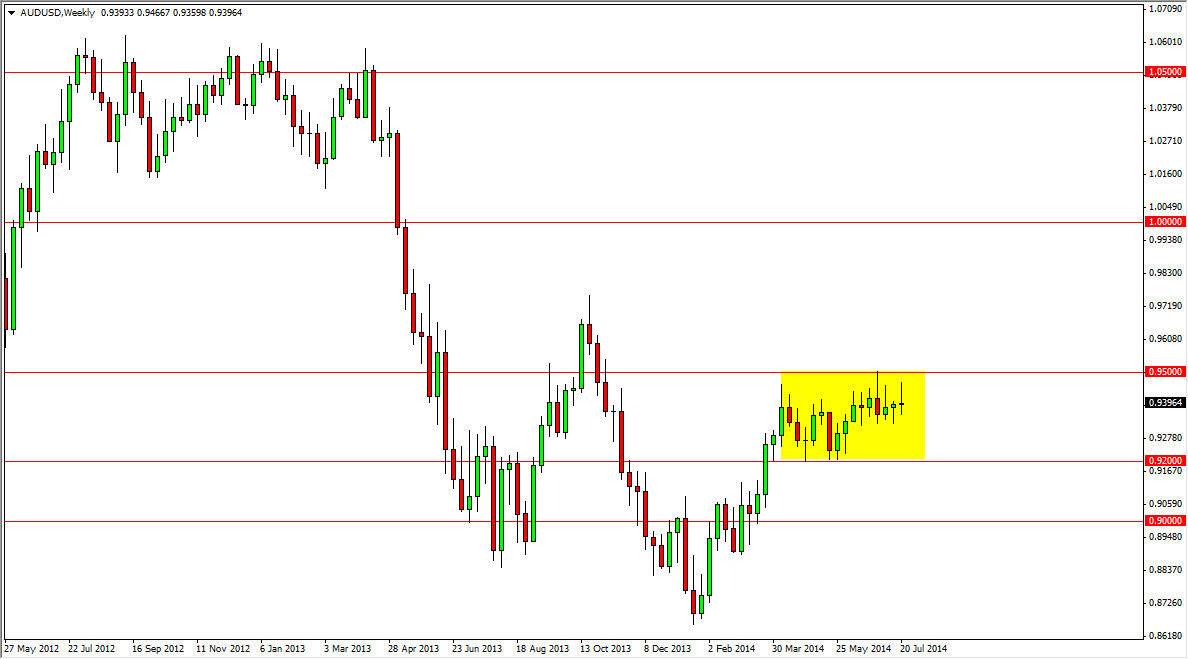

The AUD/USD pair has tried it again and again to break above the 0.95 handle, and I think that is what is going to be crucial for the upcoming month. If we can get above there, as he the reason to think that this market will head to the 0.97 level. However, with the way that we’ve struggled in this area, it would not surprise me at all to see a bit of consolidation over the next month, or perhaps even the next several months. Right now, I see this market is essentially “landlocked” between the 0.92 level, and the 0.95 level. Because of that, I feel that the market will be one that more in tune with short term trading than anything else, meaning that longer-term charts will probably become almost useless until we break above the 0.95 handle.

That being said, I believe that this market could be quite profitable.

I will be looking towards the short-term charts in order to find my way in this market. After all, when you look at the last seven or eight weeks, we’ve essentially been bouncing around between the 0.93 and the 0.9450 levels. Because of that, it’s an even easier short-term traders market, but be aware of the fact that this market isn’t truly broken down into we get below the 0.92 level. Because of that, I’m not going to short this market based upon a short-term break down below the 0.93 handle. I think it would simply bring in more buying pressure given enough time.

If we did break down below the 0.92 level, which I think is very unlikely, this market would then head to the 0.90 handle, an area that has quite a bit of support at it. Nonetheless, I feel that this is going to be a sideways mode, and the fact that it is the month where most of the large fund traders are we a holiday probably adds more credence to that idea. Expecting a big move in the month of August is asking a lot of the market some years, and the way the July may had been, and to a lesser extent June, I don’t think are going to see it this year either.