Bitcoin continues to drift lower post the resignation of Barry Silbert as the CEO of SecondMarket. The digital currency, after stagnating for nearly a whole month is now forming lows every day and is currently trading at $584.95.

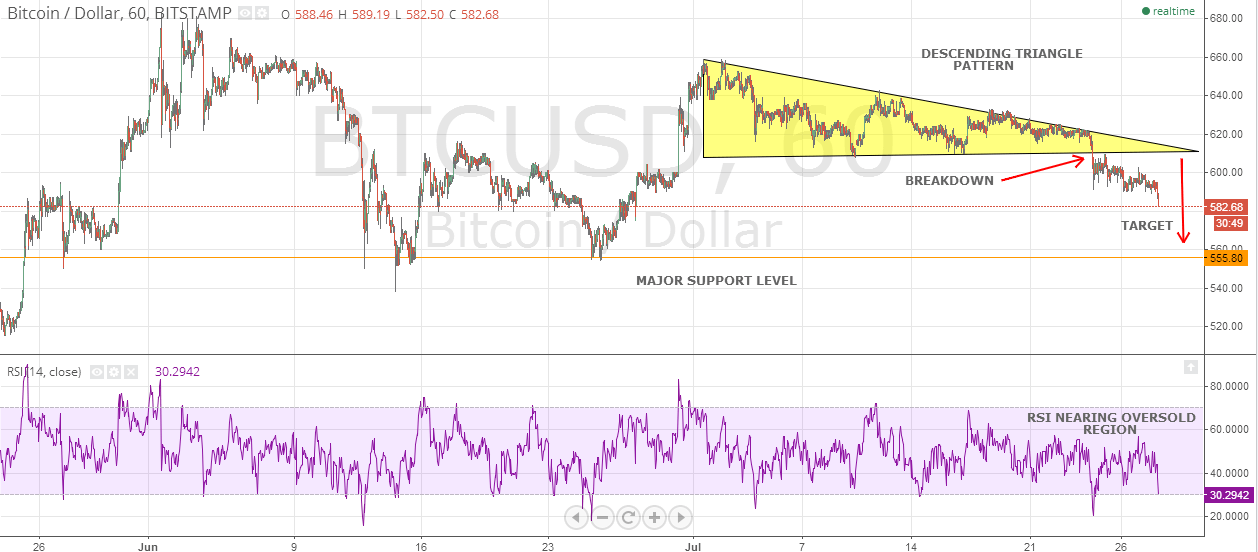

As can be seen from the hourly chart, the currency fatigued near the resistance line (the downward sloping line) of the descending triangle pattern and broke below the base support of 610. The next major support level is placed around the $545-550 mark. When looking at the overall picture, it would be fair to say that BTC/USD currently looks oversold and the RSI indicator is just above 30, hence, a pullback cannot be ruled out. However, traders must utilize any pullback as an opportunity to go short in this counter. Short positions can be built around $595 for a target of $575-580 by keeping a closing basis stop-loss just above $600. Long positions should not be considered as the profit to loss ratio is unfavorable and there is no significant sign of a trend reversal as of yet.

Bitcoin, at present, offers an attractive combination of low pricing and great prospects for long-term investors and bottom feeders who have been sitting on the sidelines to enter in these lower levels. The currency has a strong support zone around $540-550 and thus, offers incredible profit potential at low risk.

In other developments that could well shape the digital currency landscape, BTX Trader has officially launched Celery, which offers a consumer-friendly Bitcoin buying service. Customers, which were earlier unsure about how to buy fractions of a Bitcoin, will have the option now to do exactly that in a simple and clear process. Bitcoin Shop, a US Bitcoin company, has revealed its ambitions to become a “universal Bitcoin solution.” The company’s CEO, Charles Allen, announced at the North American Bitcoin Conference, that the company is now looking forward to expand its horizon and make strategic investments to complement the same.