By: Ben Myers

The USMS auction brought great news for Bitcoin traders and investors, who for a long time, have been waiting for a good breakout. After spending a considerable period near 600-610 levels, the price finally broke free and shot up nearly 7% to 640 levels owing to a successful auction in which 45 registered bidders participated.

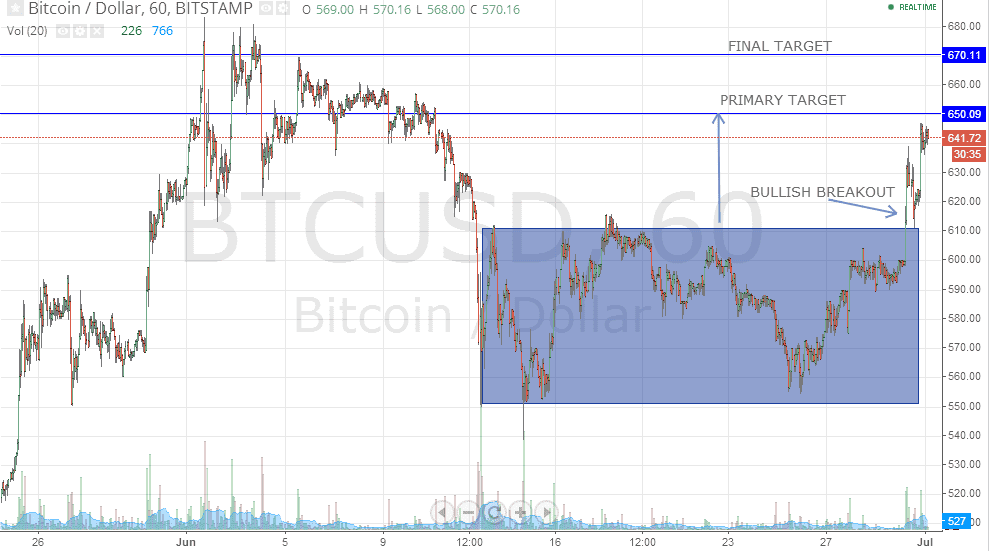

Technically, the price has clearly given a breakout and only long positions should be considered. Short-term traders who have bought at lower levels may book partial profits at current levels and look to lock in the rest at around 670. Medium to long-term investors would be well advised to hold their positions. Fresh long positions can be made upon declines while placing a stop-loss at 600 for a price target of 670. Aggressive traders are advised to build short positions near 670-675 for a target of 630 with 680 set as a major stop-loss. The chart clearly depicts 680 as a strong resistance and a close above it would be a strong bullish signal leading to a possible frantic short covering, spurring a buying interest, which could take the prices even higher.

Now that the auction is over, traders and investors must keep up with other latest developments related to digital currencies. The Australian Tax Office (ATO) has postponed its ruling on treating Bitcoin for this year’s tax submission period and has promised a ruling since February. In another major development, financial services leader MasterCard has filed for a patent to include Bitcoin to its global shopping cart. The Deloitte University Press has reiterated in a report that the media is focusing only on the negative aspects such as government crackdowns and exchange meltdowns and not highlighting the “potential long-term significance as a disruptive new money technology” that this digital currency has to offer.