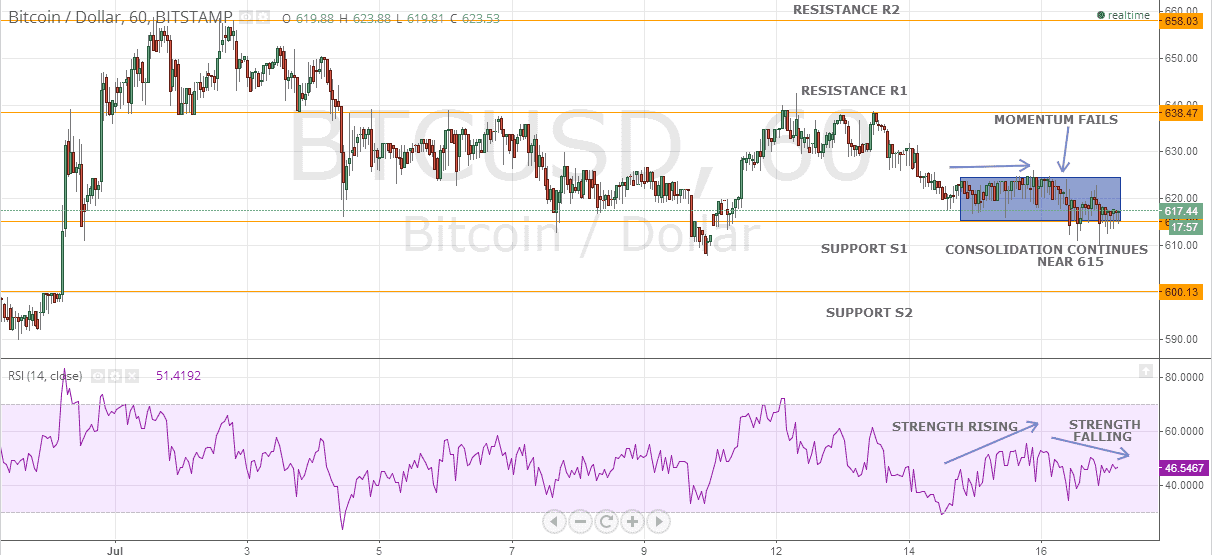

The Bitcoin market desperately needs a big news or development that could trigger a breakout in the price which has been moving sideways in a narrow band of 20-25 points since 5th July 2014. The digital currency, which is currently trading at $617.44, has been unable to maintain its strength in either direction as can be seen from the RSI indicator. The price range is getting narrower and is marked as the rectangular box.

In the event of such an extended consolidation period, traders and investors alike must get more cautious as it is mostly followed by a big swing. The BTC/USD hourly chart clearly depicts S1 as a strong support and the inability of the price to close below it is a bullish sign. Traders are advised to build long positions in this counter at current levels for a target of 630 from a near-term perspective. The stop-loss for the trade should be placed just below S1 on a closing basis.

The craze for Bitcoin continues to grow in Vietnam with the country’s first live Bitcoin exchange, VBTC launched last week. Following the footsteps of California-based Expresscoin, Bitcoin brokerage provider Trucoin has introduced buying services in eight US states which include Florida, Massachusetts, Missouri, Montana, New Jersey, New Mexico, South Carolina and Texas. Optimal Payments PLC-owned NETELLER has restricted all the transactions involving virtual currencies in the revised terms of services agreement. Elliptic has successfully raised funds to the tune of $2 million from Octopus Investments to further the product development for its Bitcoin Vault services. TradeBlock, led by Andreessen Horowitz, has managed to raise $2.8 million in funding to focus on its order management system for over-the-counter trading. GHash, in an effort to assuage the concerns of the Bitcoin community related to the 51% threat, has agreed to cap its share of the total Bitcoin network to 39.99%.