By: Ben Myers

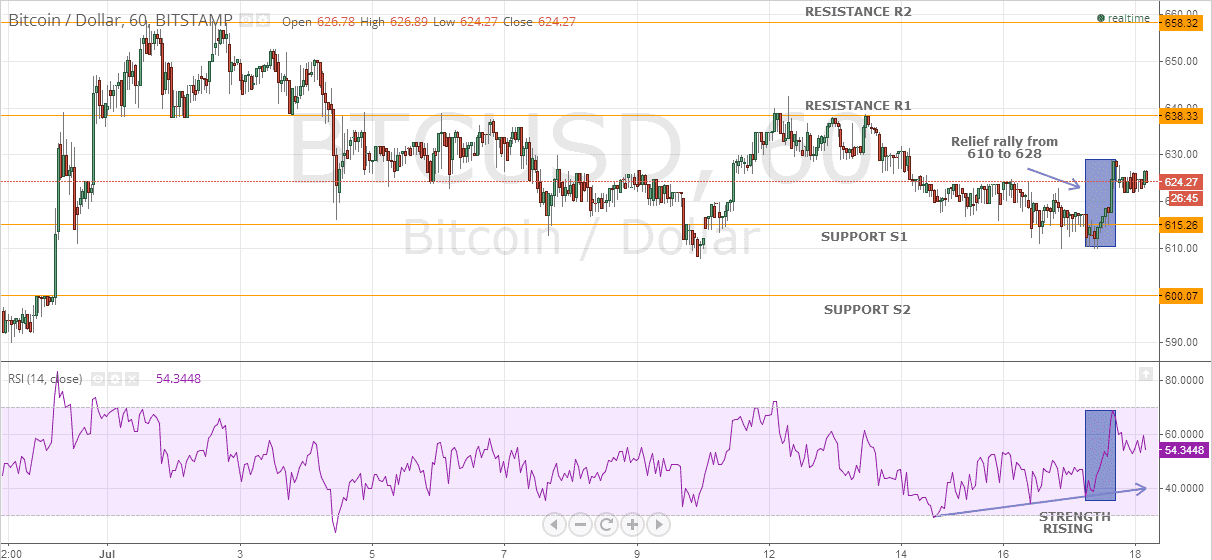

After spending a considerable amount of time consolidating near 615, Bitcoin has finally witnessed a “relief” rally on the back of rising strength. During this, the digital currency jumped from 610 to 628 but has been cooling off since then and is currently priced at $624.27. But, despite the disappointing break in the swift rally, one feature worth mentioning is the slow and steady climb of the relative strength (which can be seen as the upward trendline in the RSI graph) and bodes well for the future movement of the virtual currency.

As can be seen from the BTC/USD hourly chart, Bitcoin is currently placed at a level equidistant from R1 and S1 and hence, the risk/reward ratio is an unhealthy 1:1. Having said this, the traders must wait for a 1-1.5% move in either direction before trading the instrument. Short positions may be considered near 630-635 for a target of 618 by placing a stop-loss (closing basis) just above 638. Long positions are advised only at lower levels close to 615 with a stop-loss (closing basis) placed just below 610 for a target of 628.

Good news continues to flow in for Bitcoin as South Africa’s PayFast has added Bitcoin as a payment method to its platform. The payment giant has partnered with BitX to process the payments of over 30,000 online merchants. This development comes just a day after a South African e-commerce giant Takealot announced that it is accepting PayFast’s services to accept Bitcoin payments.

Considering that millions of dollars are being invested in the Bitcoin-backed businesses, calls for clearer regulations have been growing for some time. The latest ones to raise their voice are the lawyers and the Bitcoin groups in Australia who are demanding clarity on the rules and regulations for both businesses and consumers in the digital currency landscape.