By: Ben Myers

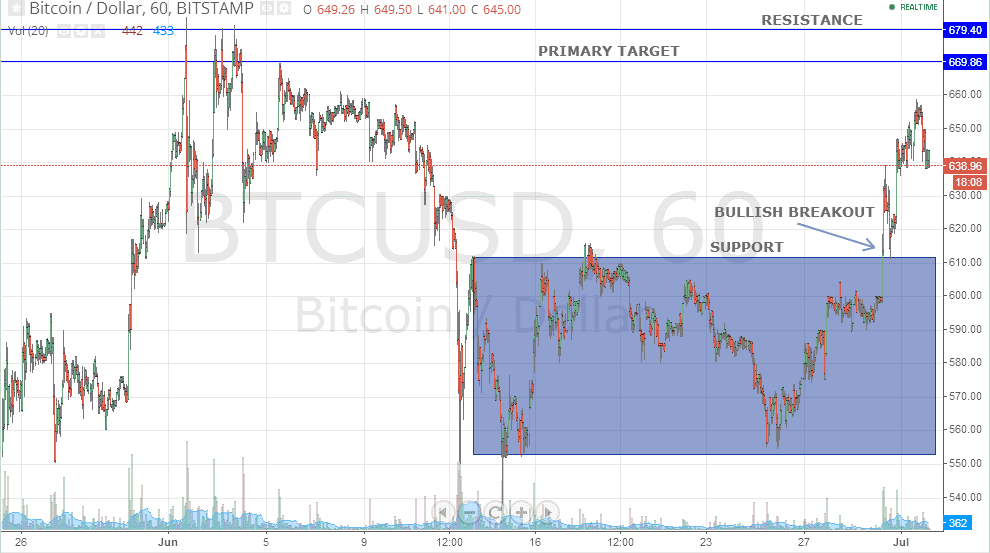

As can be seen from the hourly BTC/USD chart, there has been some considerable profit taking after the price moves past the 650 mark. After registering a bullish breakout at around 610, the price of Bitcoin leapt towards 658 on strong fundamental support, with a flurry of positive announcements and auctions supporting the long-term viability of the digital currency. Since then, BTC/USD has been facing profit taking which dragged the price below 640. Bitcoin is currently trading just shy of 640 at 638.96. The primary target of the digital currency lies at 670 whereas all long positions must definitely be closed near the strong resistance level of 680 (as per chart).

Traders should refrain from buying at current levels as the profit-to-loss ratio is unattractive. However, Bitcoin traders should enter the market only at lower levels of 620-610 with a stop-loss placed just below the key support level of 600. In fact, some short positions may be built on any rise towards 670 with a stop-loss fixed at 680 for a target of 630.

Investors with a medium to long-term outlook can consider building long positions at current levels and upon every subsequent decline till 550.

Following the leads of some of the biggest names, popular computer hardware and software retailer Newegg has announced that it will start accepting Bitcoin in payments and will use the services of BitPay as a payment processor. Going beyond the traditional US market, the digital currency retailer Expresscoin, has set up a new shop in Canada and offers the customers the chance to buy various digital currencies such as Bitcoin, Litecoin, Dogecoin and Blackcoin with debit cards. In a move aimed at making Bitcoin more safe and secure, BitPay has launched a project called BitAuth to facilitate a decentralized authentication system. All of which, looks to offer long term viability to the future of digital currencies, boosting the BTC/USD outlook and supporting prices.