By: Ben Myers

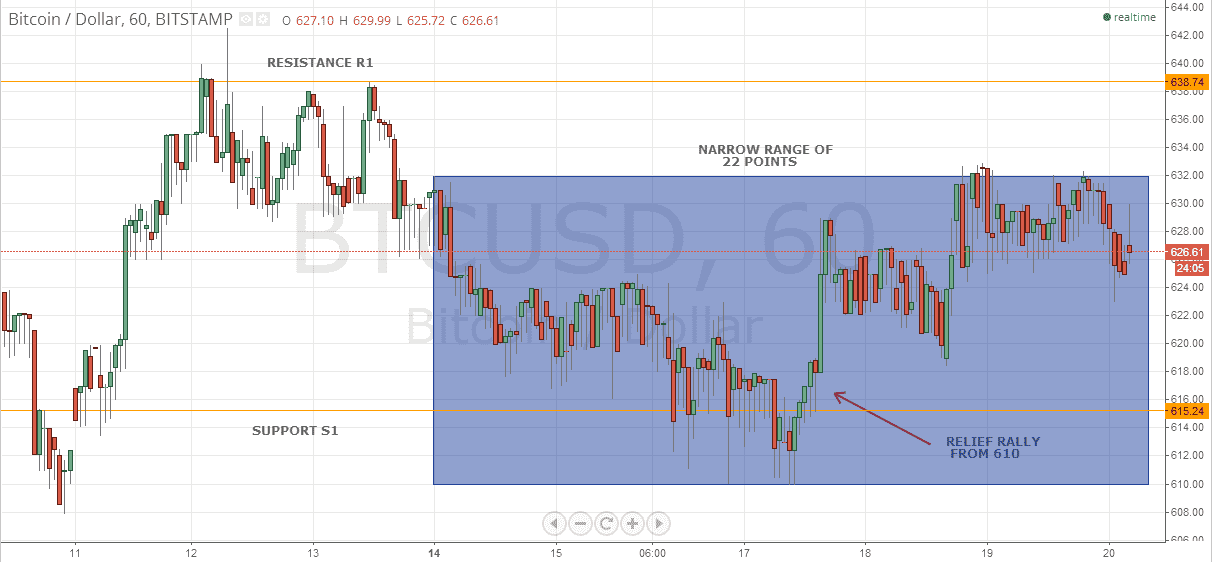

After consolidating in a narrow range of approximately 22 points, Bitcoin looks set to end the week on a flat note. Bitcoin, which is currently trading at 626.61, closed the last week at 630. This week started off with a correction, which immediately took the prices from 632 to 620. As can be seen from the BTC/USD hourly chart, this correction continued till midweek when the digital currency plummeted to 610. The latter half of the week was marked by the arrest of the downslide and a swift relief rally which came in at 610 and took the price to 628. Bitcoin has since then managed to avoid any major correction and is comfortably placed above 620.

615 and 638 continue to be the key support and resistance respectively.

This week witnessed some major announcements and most of them bode well for the future of this virtual phenomenon. Acknowledging the crypto-revolution, Dell has announced that it will start accepting Bitcoins as a mode of payment through a partnership with Coinbase. Dell is now the world’s largest business to accept the digital currency, surpassing Dish Network. Takealot, the e-commerce giant based in South Africa, has started using PayFast’s services to process online Bitcoin payments. But the good news from South Africa does not end here as PayFast has itself added Bitcoin as a payment option to its platform, providing its 30,000 online users with greater payment flexibility. With the calls of clearer framework and the protection of consumers growing louder, the New York Department of Financial Services (NYDFS) has released a set of rules and regulations for all New York-based businesses. Taking a cue from this success in New York, Australian lawyers and Bitcoin groups have started joining similar foreign communities to raise the voice for a greater clarity on regulations and framework for both businesses and consumers.

Currently, everything seems to be going in favor of the cryptocurrencies and its users with some minor bumps, but Bitcoin looks set to lead the digital currencies going forward with more countries and businesses accepting this phenomenon.