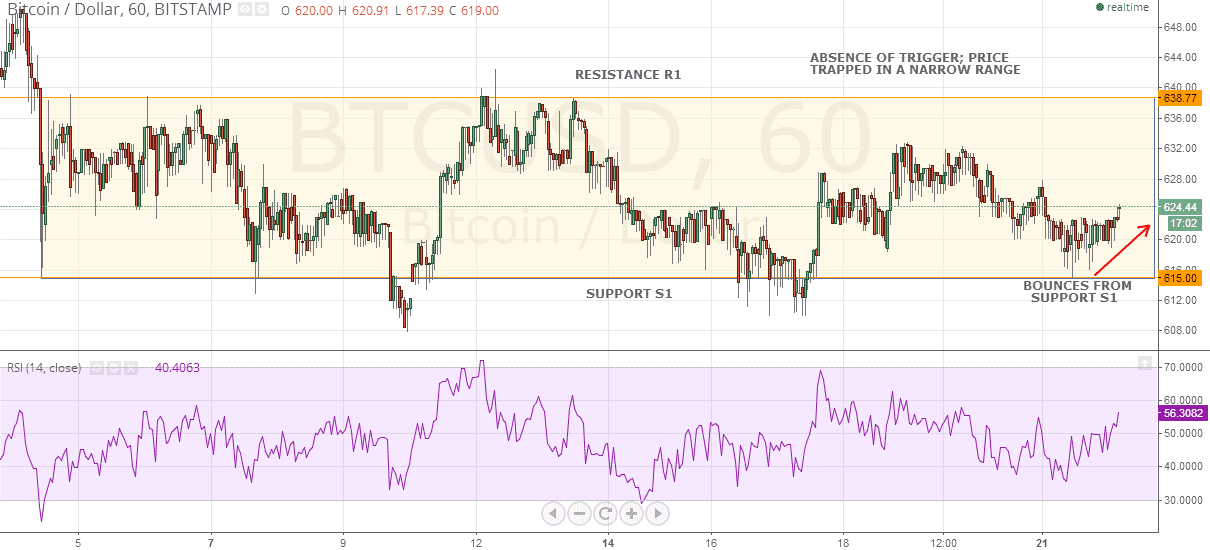

Bitcoin continues to trade in a rangebound manner with no immediate signs of a breakout as yet. It seems that the bulls and the bears are in no mood to flex their muscles to get it their way and are rather just waiting for the other party to tire out. Even the big bang announcement from Dell that it will start accepting Bitcoin as a payment option could not lift the mood of the market. As can be seen from the hourly chart, BTC/USD has again bounced-off from support S1 and is now placed comfortably at $624.44.

Traders must use this range to their advantage and adopt a fairly simple “buy low, sell high” strategy. Only long positions should be considered near 610-615 with a stop-loss placed just below 610 for a target of 630. It must be noted that the current scenario provides ample opportunities to range trade the pair without any deep stop-losses and hence, minimizes the risk. Short positions should only considered close to 635-638 with a closing basis stop-loss placed just above 640 for a target of 618.

In a first of its kind initiative, an airline company has now offered to accept payments in Bitcoin. Latvian airline airBaltic may soon become the first company to accept the digital currency for flight bookings. Although a formal announcement is awaited, but the company’s website has started displaying this unique development. New York State has, in an effort to curb illegal activities in the digital currency landscape, proposed licensing for the Bitcoin-based businesses. BitLicence, as the proposal has been formally called, would require the businesses to keep a record of their customers. This is indeed a welcome move and has made New York the first state in the world to have come out with such a regulation.