By: Ben Myers

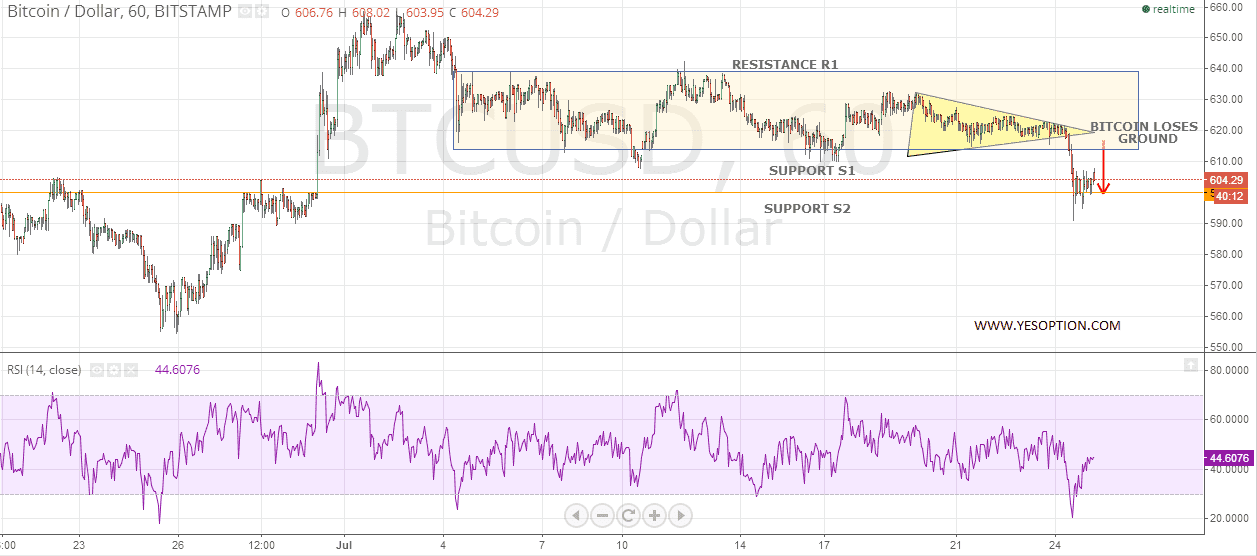

Bitcoin has finally freed itself from the trading zone and touched the levels which have not been seen since the start of this month. As soon as the news of noted investor Barry Silbert resigning from the post of CEO of SecondMarket broke out, Bitcoin, which was already trading in a very narrow zone, immediately plummeted and broke through the major support levels, S1 and S2. Though the resignation initially spooked the investors and the traders alike, the ex-SecondMarket’s CEO’ statement that the transition would allow him to focus 100% of his energy on digital currency business has managed to calm their fretted nerves and the currency is at present stabilizing just above 600 at 604.29.

Traders who have gone short below 615 are advised to book their profits and consider long positions around 595-600 for a target of 615 by placing an intraday stop-loss just below 590. Short positions should be avoided at the current price as the profit-to-loss ratio is unfavorable. Medium to long-term investors may consider adding it to their positions or start afresh at current levels, keeping a stop-loss below the fundamental support of 540-550 range.

In other events that affected the digital currency market, Alienware, a subsidiary of Dell Inc., has announced that it is now accepting Bitcoin in payments. In fact, to promote the use of Bitcoin as a payment option, the company has offered a promotional discount of up to $150 on Bitcoin payments. Australian Bitcoin firm DigitalBTC has reported positive cash flows in its first quarterly earnings, owing to the success in the Bitcoin mining activities and the Bitcoin liquidity propositions. New York-based Bitcoin exchange Coinsetter has completed its Beta stage and is now set for a launch with an incredibly lower exchange fee of 0.10% to target active institutional traders. It must be noted that a lower exchange fee has been the point of contention for quite some time and Coinsetter’s recent proposal might just start a new price war.