By: Ben Myers

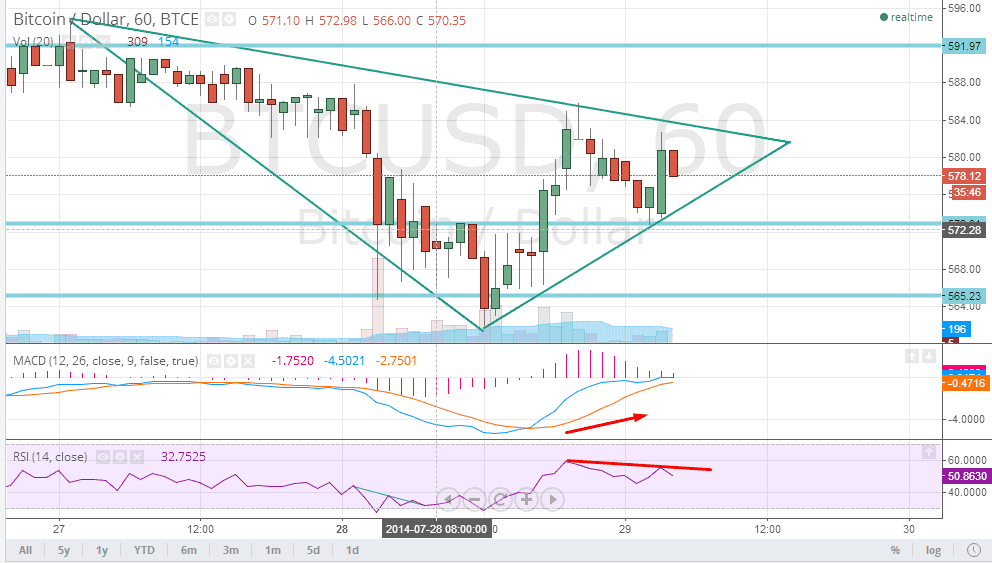

After breaking from the near-month long narrow trading range, BTC/USD has formed a triangle formation and is trading within a new range. In yesterday’s trading session, after hitting an intraday low of $561, a smart pull back saw the BTC/USD move above the resistance zone at $571 on the back of strong volumes. BTC/USD found resistance at the upper end of the triangle and the MACD for the BTC/USD has provided a fresh buy signal although traders should be way of the ‘dead cat bounce - A temporary recovery from a prolonged decline or bear market. The only cause of concern for traders at present volatility levels; is the way the relative strength index is behaving, as it has provided a fresh sell signal forming a lower high. The support zone for the BTC/USD stands at $572 and $561 while resistance comes at around $583 and $592.

BTC/USD got a boost yesterday after Apple Inc (NASDAQ:AAPL) allowed a Bitcoin app from blockchain on its Appstore, which was preciously pulled down in January. The development is termed as a major event for the long term prosperity of Bitcoin as Apple's move reflects a growing acceptance of the virtual currency.

Despite surrounded by a series of controversies, Bitcoin-based entrepreneurs and businesses are now looking to launch the cryptocurrency in the online gambling industry. The hopes come after the recent ban by NETELLER, which is an influential internet payment service. NETELLER located on the Isle of Man specializes in digital currency deals, particularly into the online gambling industry, but has decided to stay away from the virtual currency. However, other market players in the same region are cautiously, but positively, embracing the digital currency in order to monetize it.

Going forward developments like these would play a key role in deciding the direction for BTC/USD in short term.