By: Ben Myers

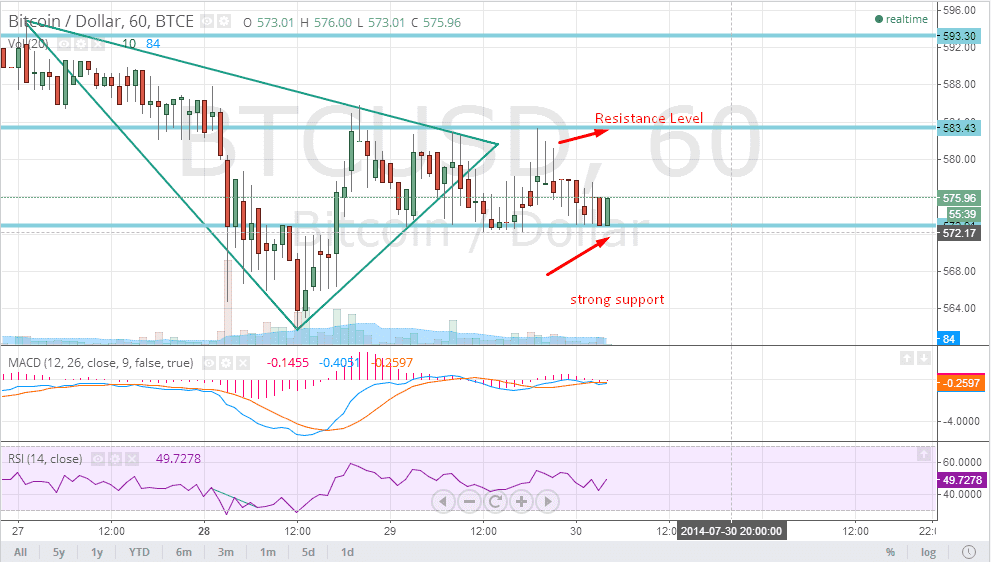

BTC/USD on the hourly charts broke below the triangle support line in a volatile trading session yesterday. BTC/USD tried breaking above the resistance zone within the triangle but found considerable amount of selling pressure at higher levels. It is currently seeking support at the $572.12 level that is the last hope for bulls. BTC/USD is facing stiff resistance at $583.43, a level which has seen selling pressure emerge whenever it tried to cross that level in yesterday’s trading session. The MACD for the BTC/USD is currently in bearish territory and showing no signs of a reversal. Therefore, it becomes imperative for traders to keep a close eye on the support zone of $572.12, which if breaks, can take the BTC/USD to a new low level of $560 in the near term similar to the MACD, the relative strength index is showing no signs of inherent strength.

Traders should go short on the BTC/USD if it breaks $572.12 with a stop loss of $585 and for a potential target of $560. Long positions should be initiated only above $585 with stoploss at $570 for target of $600.

Other fundamental developments which will have impact on Bitcoin trading would be the release of draft regulations governing Bitcoin in New York State; the virtual currency supporters have parted ways in terms of their ideology over the proposed regulations. Mainly small start-ups are concerned that the regulations will crush their businesses but others think that the laws could revolutionize the cryptocurrency space. In the meanwhile, some of the Bitcoin supporters are about to send an open letter to Benjamin M. Lawsky, the New York State's highest financial regulator, requesting him to extend the time for submitting comments on the draft regulations.

In a separate development, Romania is proving to be the ‘New China’ for Bitcoin as Europe's poorest country adopts the usage of virtual currency at a rapid pace. The region already boasts of a Bitcoin ATM in its capital Bucharest now, while it is a home to the first Bitcoin exchange as well. The interesting factor is that the Bitcoin exchange holds a record of adding over 2,000 new clients within a short time of seven months. With the growing craze of Bitcoin, traders and clients agree that a form of legislation will be helpful.

Finally, Dutch based easy Hotel Franchise has said that it will accept bitcoins as payment for hotel bookings made at any of their hotels in Holland. The move marks set yet another example as how travel industry is fast embracing bitcoin. Recently, Expedia had started accepting Bitcoin payments for hotel reservations.