By: Ben Myers

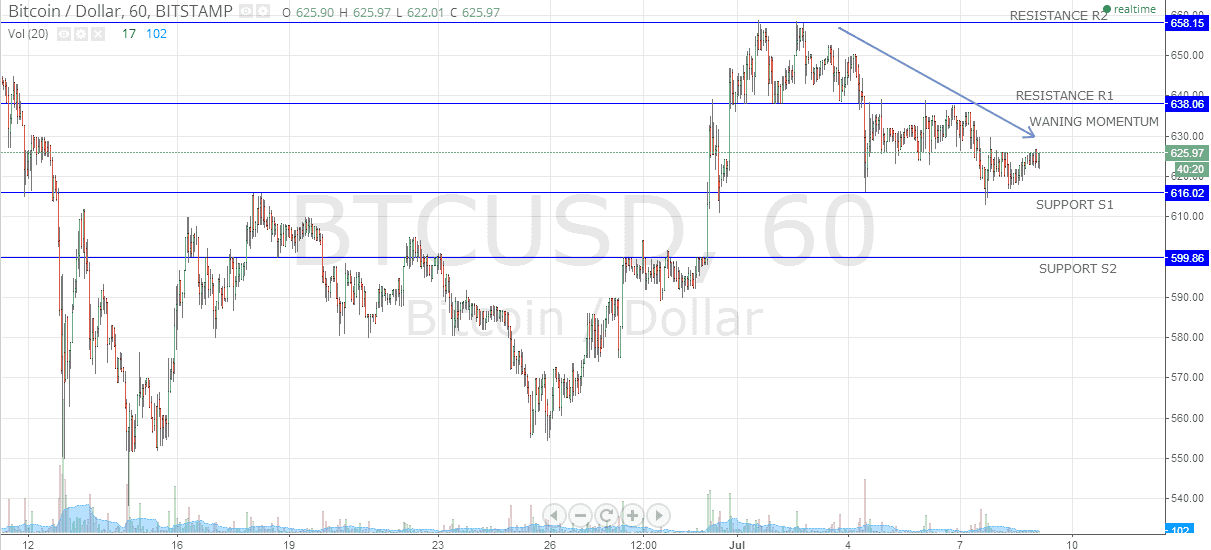

BTC/USD has formed a lower-top lower-bottom structure with no signs of a trend reversal as of yet. The momentum has clearly weakened and the price is expected to continue to drift lower. It has become highly probable that owing to a lack of major triggers, levels of 600 may be seen in the next couple of trading sessions.

The level of 638 (R1) continues to act as a pressure point for the pair and only a close above it would signal a trend reversal. Long positions should be avoided from a near-term perspective and a sell on rise strategy may be considered on every rally. Short positions may be built if the pair bounces close to 635 for a target of 615 keeping a strict stop-loss at just above 640. A close below 615 would also confirm a bearish price action and short positions can then be considered for near 600-levels with a stop-loss set at 620. All short positions must be booked into near 600 (S2) as a rebound is expected from the strong support zone. Some long positions may be considered close to 600 for a target of 615 with a stop-loss set at 597.

Putting an end to the long-pending speculation concerning the status of Bitcoin, Poland’s deputy finance minister Wojciech Kowalczyk has released a document confirming that even though Bitcoin is not an officially recognized currency, it can still be used as a financial instrument. In another move aimed at promoting the use of Bitcoin, Ukraine has constructed a nationwide network of close to 5000 terminals which allow the customers to buy the digital currency for cash. The network is currently operated by the country’s National Credit Bank and is a first-of-its-kind effort.

All these efforts highlight the fact that Bitcoin has indeed established itself and bodes well for the future of digital currencies.