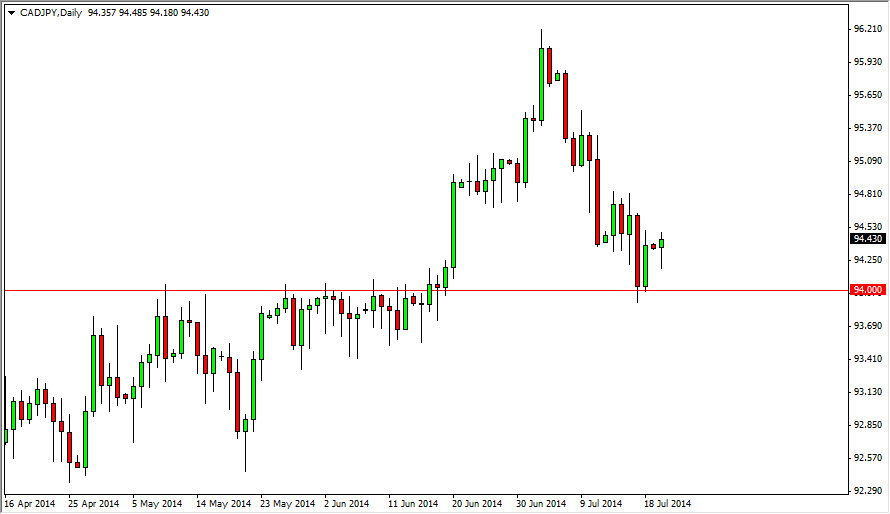

The CAD/JPY pair fell during the session initially on Monday, but as you can see the 94 level just below has been to the market previously, thereby sending the buyers into the market and having the daily candle print a hammer, which of course is a very bullish sign. With that, on a break of the top of the hammer, which I see is roughly 94.50, I would be a buyer of this market and expect to see 95 right away, and then possibly 96.

This makes a lot of sense, as the Light Sweet Crude market rose during the session on Monday, breaking through a significant amount of resistance. With that, the correlation normally means that this pair will go higher as the Canadian economy is one that’s very heavily influenced by the export of oil, and the Japanese have to import 100% of the oil they consume. In fact, a lot of people will treat the USD/CAD pair based on oil markets, but if you pay attention the CAD/JPY pair, and perhaps the NOK/JPY pair are two of the best markets to trade for that correlation. After all, the situation in the United States is changing rapidly as the Americans are producing more and more of their own energy.

Ultimately, the Bank of Japan will get its wish as well.

Given enough time, I believe that the Bank of Japan will continue to get its wish, as it does sooner or later every time the value of the Yen continues to be a problem for the export led economy. With that being the case, it makes a lot of sense that the Bank of Japan should continue to have a very loose monetary policy, and that of course will mean more stimulus, and that stimulus should continue to devalue the Yen given enough time. With that in the oil markets working in the favor of a weaker Yen, it’s very likely that this pair goes much higher.

At this point time, I believe that a break higher is one that will lead me to buy dips in this market place as we continue to aim for higher levels, and ultimately head to the 100 level, just as we had seen in the USD/CAD pair.